5 Interesting Pointers to note for Vicom Limited 2015 Full Year Report

Vicom Limited (SGX: V01) announced their financial results for the year ended 31 Dec 15 on 4 Feb 16, after trading hours.

Before we break down Vicom’s financial results, let’s take a quick look at what Vicom does.

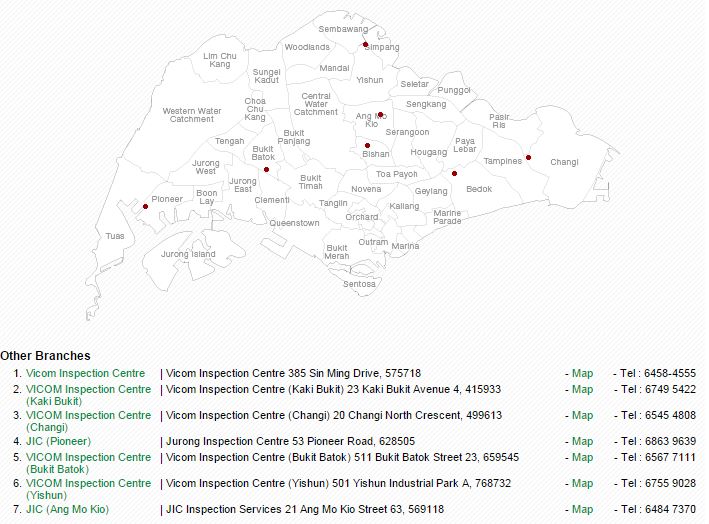

VICOM Limited is a holding company with 2 main business segments. It has a vehicle inspection company and, SETSCO, its non-vehicle inspection and compliance company. Vehicle inspection is a government mandated necessity for vehicle owners and thus very transactional. Most customers have no loyalty or preferences on vehicle inspection companies and would go to the nearest or most convenient inspection centre. As Vicom owns 7 of 9 inspection centres in Singapore (see map below), it has the largest catchment area, thus owning 70% of the market share.

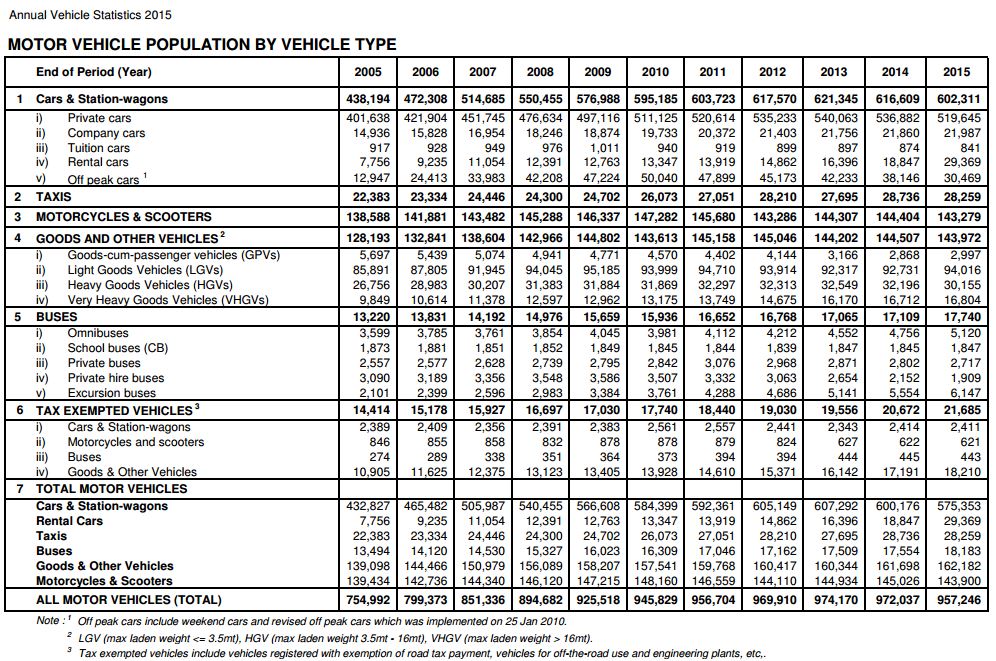

The table below shows the types of vehicles, frequencies and costs of inspection. Based on LTA, Singapore had about 950,000 vehicles in 2015.

| Frequency | Cost | |||

| Age of Vehicles | < 3 years | 3 – 10 years | > 10 years | |

| Motorcycles and Scooters | Nil | Annually | Annually | S$18.19 |

| Cars | Nil | Biennially | Annually | S$62.06 |

| Tuition Cars | Annually | Annually | Annually | S$62.06 |

| Private Hire | Nil | Biennially | Annually | S$62.06 |

| Taxis | 6 monthly | 6 monthly | NA | S$62.06 |

| Public Buses | 6 monthly | 6 monthly | 6 monthly | S$72.76 |

| Other Buses | Annually | Annually | 6 monthly | S$72.76 |

| Light Goods Vehicles | Annually | Annually | 6 monthly | S$62.06 |

| Heavy Goods Vehicles | Annually | Annually | 6 monthly | S$72.76 |

| Buses | Annually | Annually | 6 monthly | S$72.76 |

| Trailers | Annually | Annually | Annually | S$62.06 |

Source: vicom.com.sg

Knowing what Vicom does, let’s dive into the financial results. Here are 5 points to note for Vicom and its FY15 financial results:

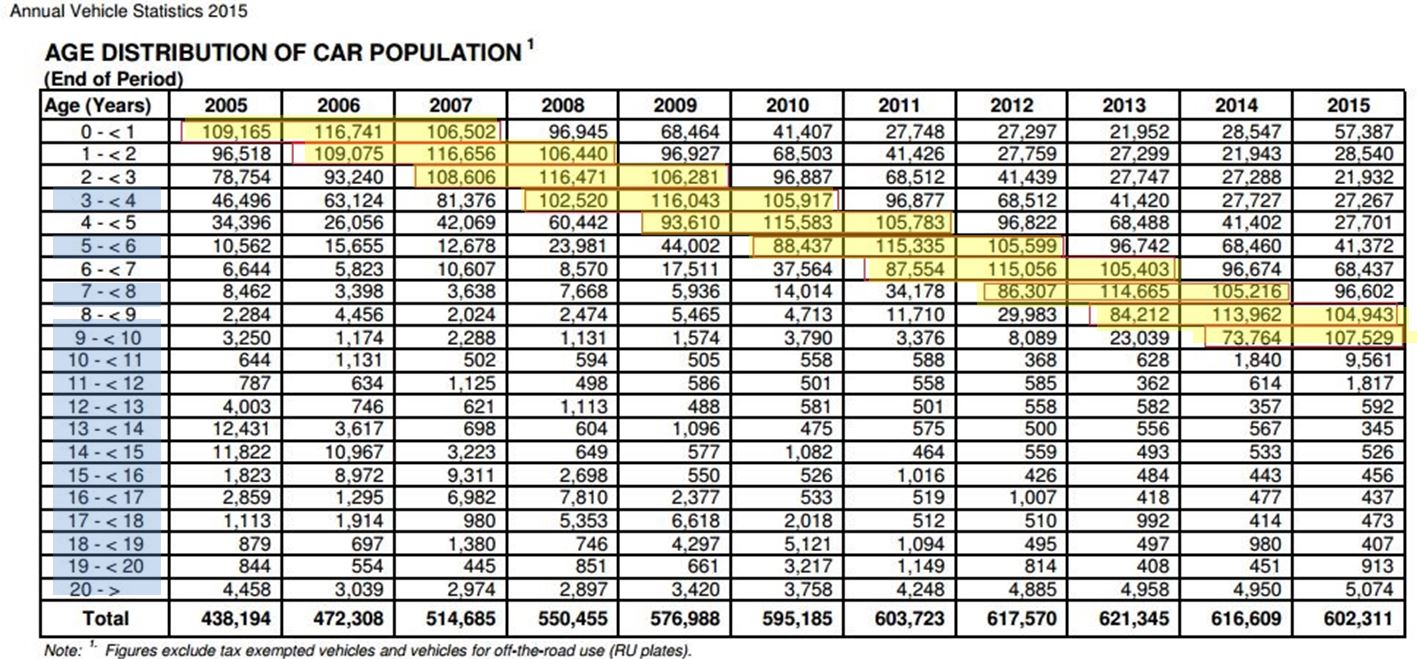

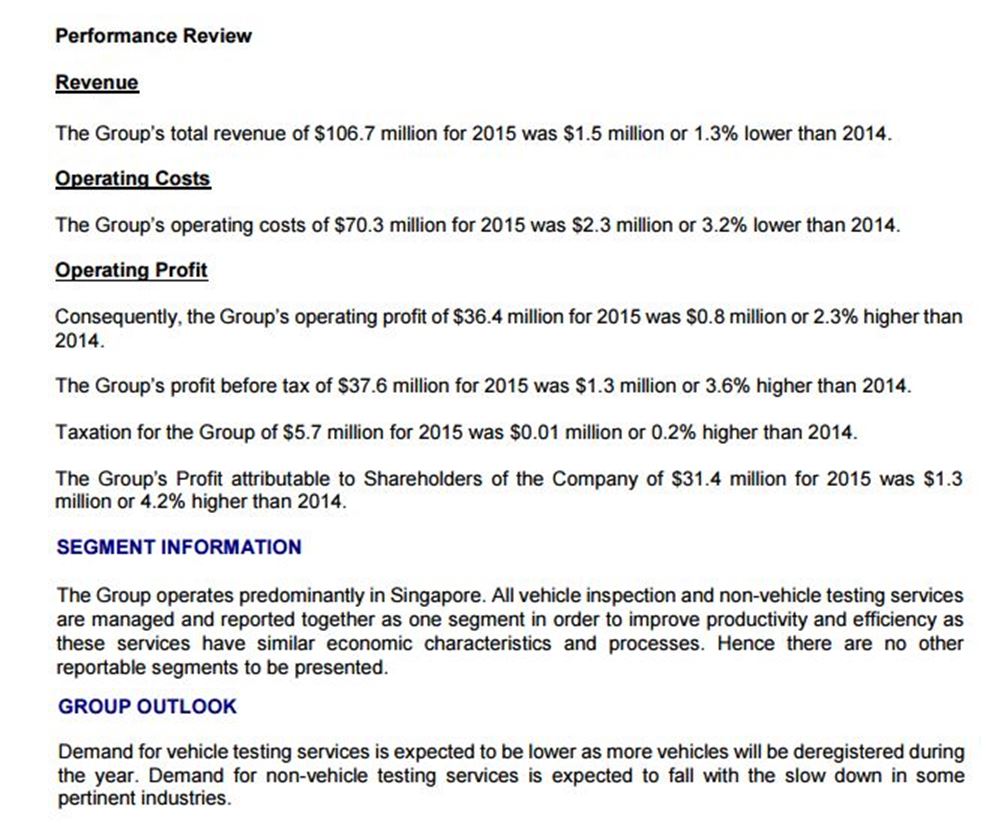

- Revenue fell 1.3%, from S$108 million in FY14 to S$106 million in FY15. This was expected as there were bumper crop years (highlighted in yellow) for the registration of vehicles from 2005 to 2007. Most owners chose to deregister their cars after the tenth year as you can see from the chart below from the drastic drop in car population after the tenth year. Hence, it would be normal to see a slight decrease in revenue going ahead from 2016 to 2018 as more vehicles continue to deregister. However, Vicom has very strong pricing power and can choose to increase prices to offset the decrease in volume.

- Although revenue had gone down 1.3%, net profit after tax increased by 4.2%, from S$30.5 million to S$31.8 million. How did they manage to have an increase in net profit despite falling revenue? The answer lies in the expenses column. Vicom managed to cut more than 15% of their expenses, from material and consumables to repair and maintenance, utilities and communications segments. However, comparing that with FY14, this cut could possibly be one-off.

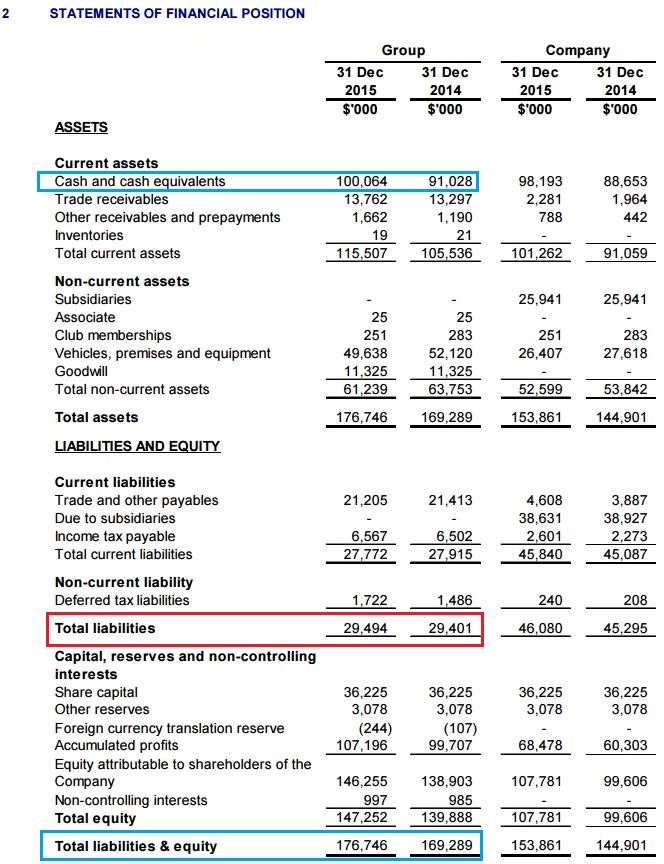

- Vicom is simply cash-rich. Looking at its balance sheet, you will find that cash and cash equivalent (CCE) make up 56.6% of the company’s balance sheet! To sweeten the deal, it does not have any debt in its balance sheet. Its total liabilities are only S$29.4 million; the cash it holds could easily cover the liabilities 3 times over!

- Vicom is the perfect epitome of a wonderfully boring business. There has not been drama, hype or scandals heard about Vicom. Peter Lynch and Warren Buffet love businesses that are boring, free from drama. Not only is Vicom a boring business, its annual report is also written in a boring way. As the old adage goes “pictures speak a thousand words”, I’ll let the various snippets extracted from the Financial Report do the talking.

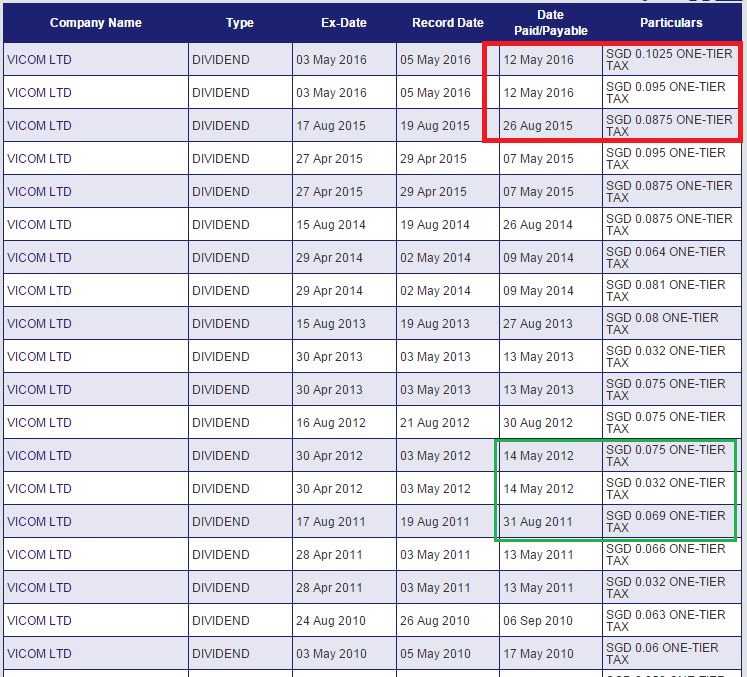

- Vicom’s dividend increased by a stunning 8.2%, from 18.25 cents for 2H14 to 19.75 cents in 2H15. Despite the increase in dividend, dividend payout ratio merely increased by 1%, from 78% to 79%. Looking at the entire year, dividend increased from 27 cents in FY14 to 28.5 cents in FY15, a 5% increase. Vicom has been steadily increasing its dividend. Just 5 years ago, in FY11, its total year’s dividend was 17.6 cents. That is a CAGR of 10.2%!

Conclusion

Vicom seems to have built up a considerable war chest in preparation for the storms ahead. Despite potential headwinds, Vicom managed to increase net profit and dividend. Today, we only spoke about its vehicle inspection segment. We have not even considered its other segment; SETSCO, which had been doing well in the past few years. However, not all are bed of roses for Vicom as increasing deregistration of cars could impact their future revenue. Moving ahead, we will closely track the number of vehicles that are registered, and the inspection prices.

We are digging deeper into some of the fundamental details on Vicom and will be sharing the findings with our friends in our mailing list. If you are not yet in our mailing list, and would like to know more about Vicom, do sign up for the newsletter here!

Note: Vested. Please exercise independent thinking.