First REIT to acquire Siloam Hospital Labuan Bajo

Byte Sized News: First REIT expands asset base In Indonesia with acquisition in Labuan Bajo

On 7 Nov 2016, Bowsprit Capital Corporation Limited announced that First REIT has entered into a conditional sale and purchase agreement with an indirect wholly-owned subsidiary of PT Lippo Karawaci Tbk, for the proposed acquisition of Siloam Hospitals Labuan Bajo (SHLB) at a purchase consideration of approximately S$20.0 million.

An EGM would be convened soon for shareholders to approve this acquisition.

Here are 5 things to know about the acquisition.

1. Siloam Hospital Labuan Bajo acquisition increases First REIT’s Net Property Income by $1.81 million, a 1.82% increase.

This acquisition was FirstREIT-esque, with the typical characteristics such as triple net 15 year lease to Siloam the operator of the hospital. Triple net lease reduces First REIT’s risk while the 15 year lease increases earnings clarity.

At the same time, the acquisition also increases First REIT NPI by S$1.81 million from 2015’s full year NPI of S$99.27 million, representing a 1.82% increase. An estimate based on 9 months ending Sep 16 shows that this acquisition could increase DPU by S$0.05/share.

Triple Net Lease – On top of having the tenant (Siloam) bear the costs of leasing, tenant also have to pay the net amount for three types of costs, including net real estate taxes on the leased asset, net building insurance and net common area maintenance. This type of lease can also be referred to as a net-net-net (NNN) lease.

2. Acquisition results in Net Book Value per share of S$102.83

The S$20 million acquisition would increase First REIT AUM to S$1.29 billion, and NAV to S$102.83. The last traded price of $1.31 on 7 Nov represents a 28% premium in its share price to its book value per share.

The acquisition would be bought at a 2.6% discount from the average of two independent valuations of Siloam Hospital Labuan Bajo. It would be funded by internal cash and debt facilities.

We also note that the acquisition of S$20 million on Siloam Hospital Labuan Bajo and the news of S$40 million acquisition plan (9.69% discount from independent valuations) of Siloam Hospital Yogyakarta on Feb 16 summed up to the S$60 million perpetual securities issued on Jul 16. The perpetual securities had been fully utilised for loans repayment to create headroom for debt.

It seems to suggest that management has a plan right at the start when they issued the perpetual securities. We wonder what yield accretive plans they have up their sleeves.

3. The acquisition is fairly yield accretive.

Speaking of accretive, the NPI of S$1.85 million on a S$20 million price tag represents a 9.25% rental income yield. The dividend yield of First REIT based on the closing of 7 Nov was around 6.47%. This shows that the acquisition is yield accretive. An indication of management’s capital allocation ability to increase shareholder’s value.

4. Siloam Hospital Labuan Bajo is positioned to capture the low to middle-income segment of the healthcare market.

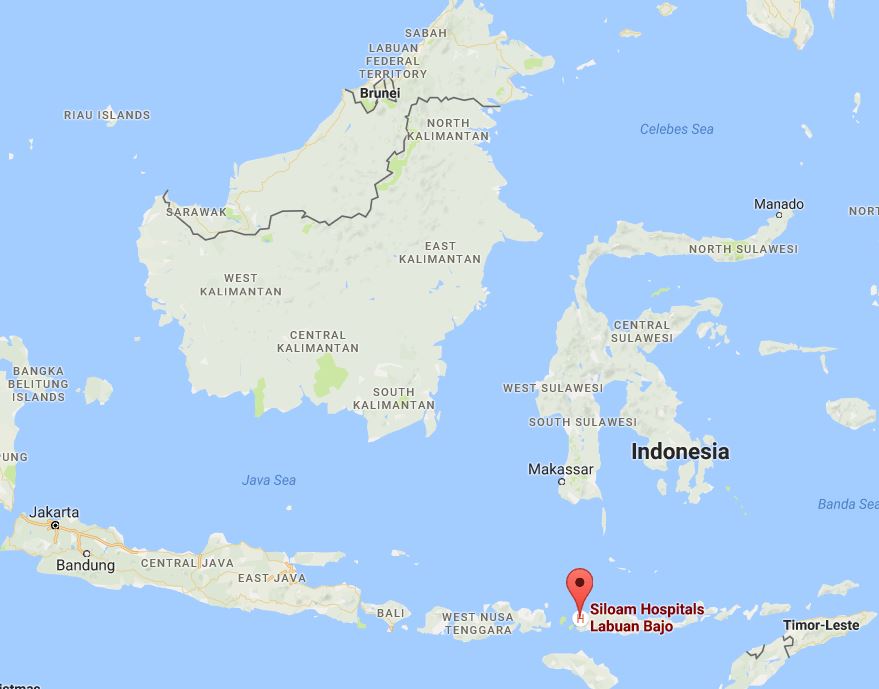

Completed in Dec 2015, Siloam Hospital Labuan Bajo is located in Labuan Bajo, West Manggarai Regency, East Nusa Tenggara Indonesia. It has the typical 24-hour Emergency Department, 101 inpatient beds, and medical specialties such as Dentistry, Obstetrics & Gynaecology, Paediatrics, Radiology, etc. You can find out more here. The room rates were typical of low to middle-income household, ranging from S$12 to S$95 for locals and $600 for foreigners.

5. 2016 a slow year for First REIT.

For the past 6 years, First REIT has enjoyed strong growth due to its yield accretive, long tenure lease acquisitions. On average, First REIT acquired 2 properties in the past 6 years. Last year, they acquired Siloam Hospital Kupang and successfully sealed the deal for Siloam Hospital Surabaya. However, First REIT only saw the acquisition of one property in 2016 (SHLB), with Siloam Hospital Yogyakarta still pending. Despite a slow year, First REIT still managed to have a DPU increase of 2% for the 9 months of 2016, compared to a DPU growth of 3.1% for the 9 months of 2015.

We believe that 2017 would be a busy year for First REIT.

Conclusion: Management has shown that they are prudent and yield accretive capital allocators. They have also shown to be capable of careful long-term planning and have delivered. Although 2016 had been slow, we believe that management is able to take the REIT to greater heights.

If you like to receive notifications on our future posts, like our Facebook page or sign up for our newsletter!

Note: Byte Sized Investments has vested stakes in First REIT.