Investing

3 Industries for Long Term Investing: Part 3 (Healthcare)

We previously shared on two of three industries (E-commerce and Rail) which we believe have long term investment potential. Today, we will round up with the third industry on the list: Healthcare: A need that you can’t save on. There are 3 major trends that support the growth in healthcare

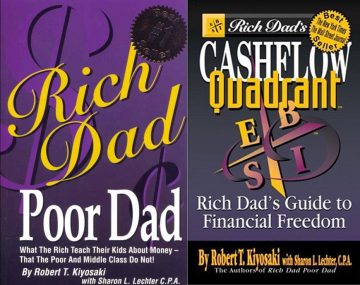

Book To Read: Rich Dad’s Cashflow Quadrant

In our previous book review, we shared Peter Lynch’s One Up on Wall Street. Today, we decided to review one of the most influential personal finance book of all time. Rich Dad’s Cashflow Quadrant, by Robert Kiyosaki, is about defining how you generate money through self-awareness and action. It examines

![Why should you invest [Part 2] everything else but 360x232 - Why should you invest [Part 2]](http://www.bytesizedinvestments.com/wp-content/uploads/2015/06/everything-else-but-360x232.png)

Why should you invest [Part 2]

We spoke about how inflation erodes one’s savings in one of our previous articles. Today, we would like to share how increasing active income is eroded by tax, and how you can increase your income in Singapore without incurring additional tax. Lastly, how to continue earning well after you have

Why You Should Invest

When people are asked why should or shouldn’t you invest? Responses range from “it’s too risky”, “I do not know how to invest”, “I have no time to monitor”, etc One of the most common response will be “Investing is too risky”. Is it really risky? Perhaps an alternate viewpoint