What do you do when the Great Global Sale Happens?

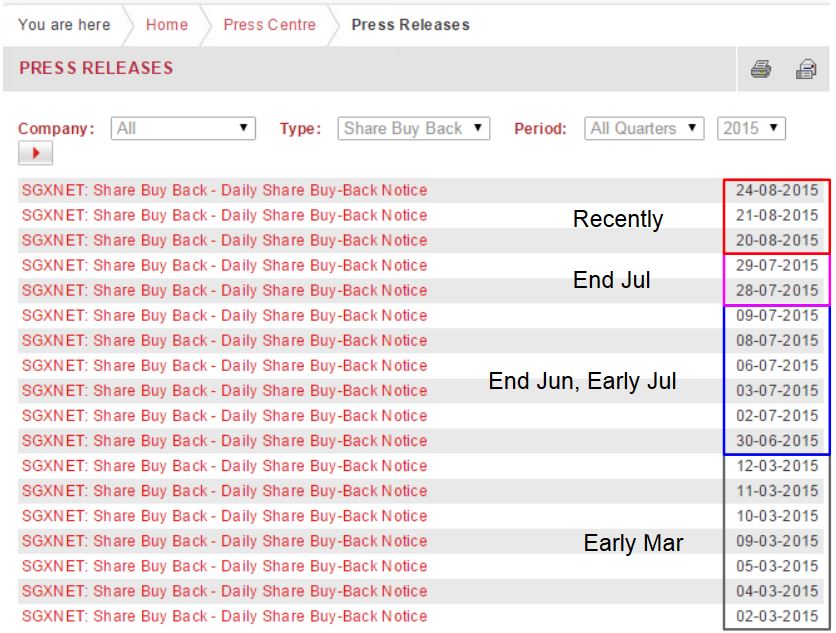

Here is one example of a company being greedy when others are fearful.

Image: Yahoo Finance

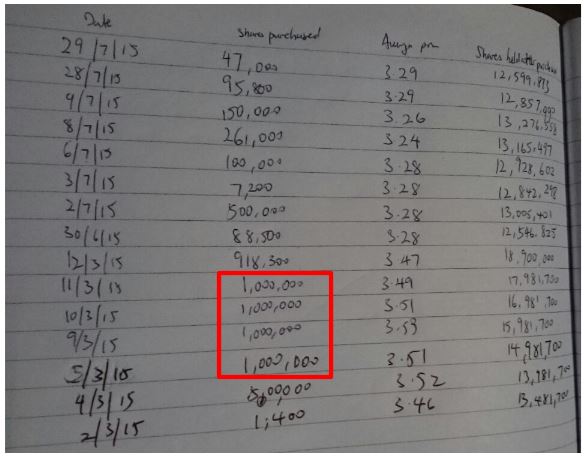

I even did quick tabulations of the transaction dates, costs and volume of buybacks. Noticed that there were a total of 4 million share buyback initiated over 5 – 11 March 15!

Image Credits: BSI

Although share buybacks are never ever an indication for you to buy the stock, it instills certain confidence when the company deploys its own cash to fund share repurchases.

Of course, one could argue that the company could be destroying value by employing shareholder’s cash to support the stock price. It is an independent and individual judgement of how you view the issue. Unless you work in the company and have access to management’s decisions, your guess is always as good as ours.

To know what company this is, do subscribe to our newsletter as we will be revealing it in a later article. We’ll also share the pros and cons of a share buyback and how you could incorporate this into your investing strategies.