Why You Should Invest

When people are asked why should or shouldn’t you invest? Responses range from “it’s too risky”, “I do not know how to invest”, “I have no time to monitor”, etc

One of the most common response will be “Investing is too risky”. Is it really risky? Perhaps an alternate viewpoint can be examined before we shed some light on this question:

- Is crossing the road risky? Perhaps…if you don’t check the traffic before you cross.

- Is driving a car risky? Yes, if you drive without a license. Well, of course, there are always people who drive dangerously even with a license. But going through the course to obtain the license equips you with the knowledge and skills to remain safe on the road.

- Is flying on an aeroplane risky? It was not considered risky in the past. But with the recent flight incidents, we might perceive flying as being more risky now than in the past.

What I’m trying to drive at is, everything we do have underlying risks, from crossing the road to taking a plane, but we still do it instead of avoiding it totally. This is because risk management are put in place to monitor the risk, eliminate or if not mitigate the impact of risk. By practising good habits at the individual level, like defensive driving and always checking blind spots, coupled with sound policies from the government, such as requiring a driver to possess a license in order to drive, risk can be managed. Similarly, in investing, good investing practices can be applied at the individual investor’s level, whilst regulatory bodies such as Monetary Authority of Singapore (MAS) or Singapore Exchange (SGX) can develop policies such as allowing purchasing of 100 shares, and also set a minimum share price to prevent incidents such as the penny stocks saga or S-Chips fraud.

Another point to note; never confuse risk with volatility. Stock prices can be volatile, moving up and down by a large margin in a single day, without any risk of losing a single cent of its business. However that will require another article to deliberate on.

In investing, there’s a chance of profiting, and there’s a risk of losing. It’s all about getting the necessary information, and determined the likelihood of a desirable outcome.

Investing as the best hedge against Inflation.

So what is the risk of not investing? In my opinion, not investing is a sure lose scenario due to inflation. Sure lose!

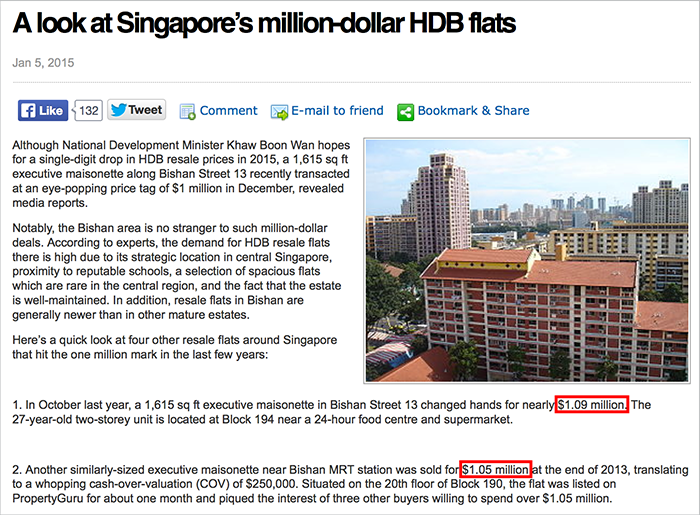

World Bank Data lists Singapore’s average inflation from 1960 – 2013 for consumer price to be 2.8%, and 2.5% for the past ten years till 2013. If we factored in accommodations, the source of many Singaporeans discontent, and private vehicles, the inflation published in Singstat from 2009 – 2013 comes to about 3.1%.

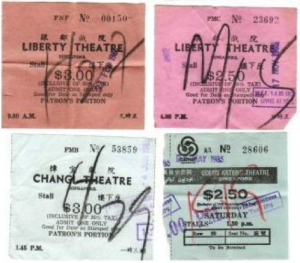

I still remember I paid between 10 cents – 30 cents on public bus fares going to school when I was in Primary School back in the late 90s. In a span of almost 20 years, based on website published by Transitlink, the same trip comes up to between 38 cents – 85 cents, a 5.3% compound annual growth rate (CAGR). Fishball noodle was $2 in the mid 90s and $4 these days, a CAGR of 7%. Finally, weekend movie tickets cost $3 in 1985. It cost $13 now today, a 7.6% CAGR.

Images Credit: remembersingapore.org

What this means is that in 2035, 20 years from now, assuming everything else is constant, using a CAGR calculator, bus ticket will cost $2.50 for trips less than 3.2km, fishball noodles will cost $16 and movie tickets will cost $55!

The list goes on and on…for housing prices, taxi fares, fuel costs, mobile plans, and etc.

If I stash my money under my bed, a biscuit tin or put it into bank savings account and let it grow at 0.025%, the $1,000 in my savings, which can buy me 77 weekend movie tickets today, can buy me only 18 tickets in 2035!

What Is Inflation?

Have you ever wondered why the cost of living grows inexorably? As the economy is a well-oiled assembly, every component will affect another one way or another. It just takes someone, somewhere making a conscious decision to charge more for the goods or services they sell, and it will send a ripple effect to the economy at large.

For example if you work in a medical firm, when you asked and got a pay raise, your company may raise the price of medical product that they are selling in order to maintain the profit margins. This causes the consumers and purchasers, patient (for example, a Bak Chor Mee operator or McDonald’s) or doctors to increase the price of Bak Chor Mee (minced meat noodle), hamburger or medical fees. All the other patronisers who eat or visit the doctor will also increase their wages or cost of goods to upkeep the increase in costs of living.

This is an over-simplified, yet true example of how inflation occurs. Inflation is a function of rapid wage increase or rising raw material prices.

So, have you expected, asked or gotten a pay raise before? 😉

Another form of inflation is due to the printing of money, commonly used during pre-war periods and recently, widely-practised by the United States, Europe and Japan to jump-start its ailing economy after a financial crisis. It is very famously coined as Quantitative Easing or QE in short. The increase in supply of money caused each individual unit of money to become worth less than it was before. This is another classic form of inflation.

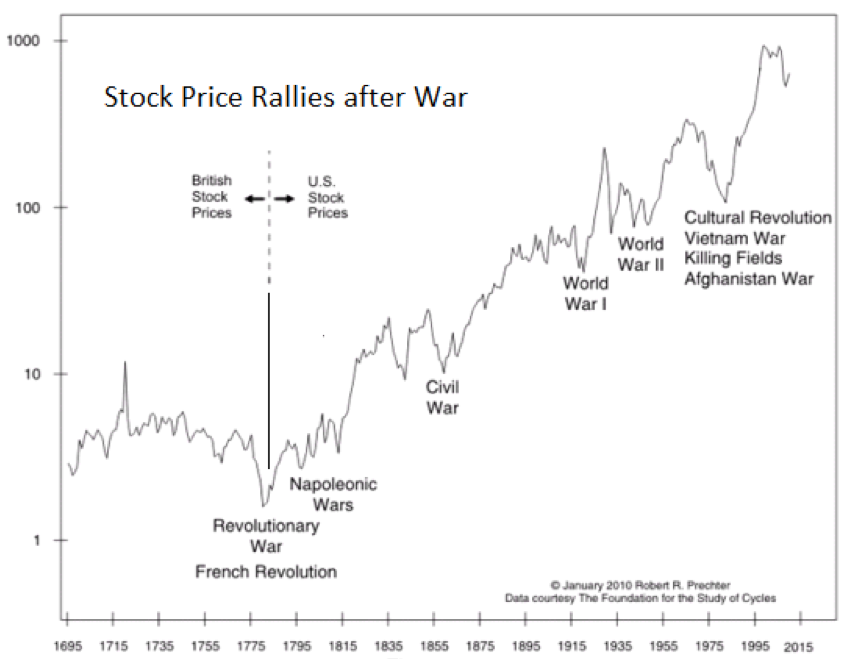

This is also the reason why each time the market returns stronger after war or some financial crisis of past, and opportunities for compounding returns.

If You Can’t Beat Them, Join Them.

We have established that inflation is inevitable due to the printing of money and the natural growing cost of goods and services due to the quest for increased standards of living.

Now when the goods and services increases, wouldn’t companies that operate the Bak Chor Mee stalls, such as Breadtalk, sell the hamburger from McDonald’s, and doctors from healthcare companies such as Raffles Medical Group benefit? They will see increases in revenue and possibly profits, and this will cause their share price to grow. Increasing profits could also spell generous dividend, which provides decent cashflow.

Like the old saying, if you can’t beat them, join them.

So instead of letting inflation beat you, why not leverage on inflation and allow it to work for you?