Why you should start investing, even as an employee

Previously, we mentioned about the Cashflow Quadrant and that people generate income from the different quadrants. They can also move from one quadrant to another. But do you know that one can generate income from more than one quadrant. An example would be a mediacorp actor, who derives his earned income from acting (employee), collects passive income and dividend through his restaurants (business) and stock investments (investments)!

Most of us are employees.

Due to Singapore’s education system and economic landscape, only a small handful of us are either lucky, dumb, industrious or adventurous enough to start their own venture. Depending on circumstances, their success ranges from being knee-deep in debts or extremely wealthy. But for the majority of us, the standard path is to graduate from school, find a safe and secure job and be an employee for the rest of our lives.

Whenever I share about investing with people, it is common to hear them saying that investing requires a large amount of capital. Their challenge was on how can they, as employees, save enough to be able to invest in order to have a significant return?

Power of Compounding is Exponential.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein, world-renowned scientist and mathematician.

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” – Warren Buffett, world’s greatest investor.

The key to achieving a sizeable capital and eventually financial independence is to follow a simple, but not easy blueprint. And the secret is through disciplined capital management, patience and let compound interest work its magic.

Today, let us explore the exponential power of compounding.

Dictionary.com describes compound interest “as interest paid on both the principal and on accrued interest”. Such a phenomenon exhibits exponential returns.

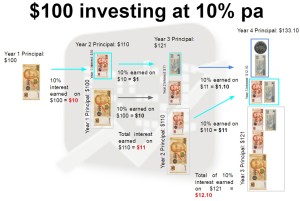

Do you know that you can generate returns of more than $11,700 just by only putting a one-time amount of $100 to work, compounded at 10% for 50 years?

Refer to the diagram below. In the first year, the interest generated at 10% from $100 is $10. The starting principal for Year 2 will be $110 and the 10% generated will yield an interest of $11. A keen mind will immediately recognise that the interest of $10 was from the basic principal of $100 and the extra $1 was from the $10 interest earned in Year 1. So by Year 3, you will have $121.00 in principal.

Interest earned in Year 3 is $12.10. Again, the interest of $12.10 earned from Year 3’s principal of $121 can be broken into two parts, $110 and $11.

As you can see, the increment in interest is exponential, not linear. This is because the interest earned from the latter years includes the interest from the year before.

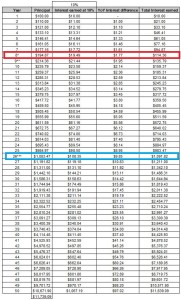

A table on $100 compounded at 10% over 50 years is tabulated below.

1. Did you notice that the total interest of $114 earned by Year 8 (in red box) is more than the $100 starting amount you have invested?

2. Did you notice that the interest of $108 earned in a year in Year 26 (in blue box) is already more than the $100 initial amount you had invested?

Did you realise that so much can be generated with just $100? Of course, generating 10% annually for 50 years is just an example. In reality, it is not so easy to generate 10% consistently, but it is possible. It will take lots of diligent work and discipline to achieve, and the results will be well worth the effort. And so far a group of investors like Warren Buffett and Peter Lynch were able to do it consistently for more than 10 years!

So, there you have it, even with a small capital, a sizable returns can still be generated if you let compound interest do the heavy lifting! Stay tuned for Part 2 on Why You Should Start Investing, Even As An Employee, by