3 Industries for Long Term Investing: Part 3 (Healthcare)

We previously shared on two of three industries (E-commerce and Rail) which we believe have long term investment potential. Today, we will round up with the third industry on the list: Healthcare: A need that you can’t save on.

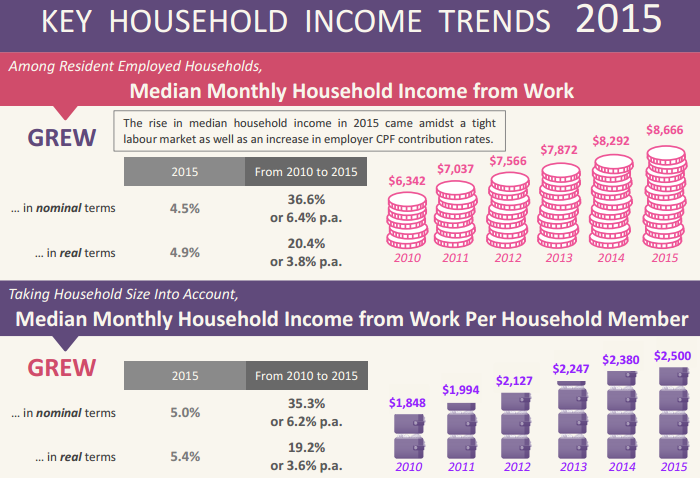

There are 3 major trends that support the growth in healthcare industry: Increasing world population, increasing life expectancy and increasing affordability. In short, more people are growing older and staying older, and are able to spend more to stay healthier. These trends can be seen both internationally and in Singapore.

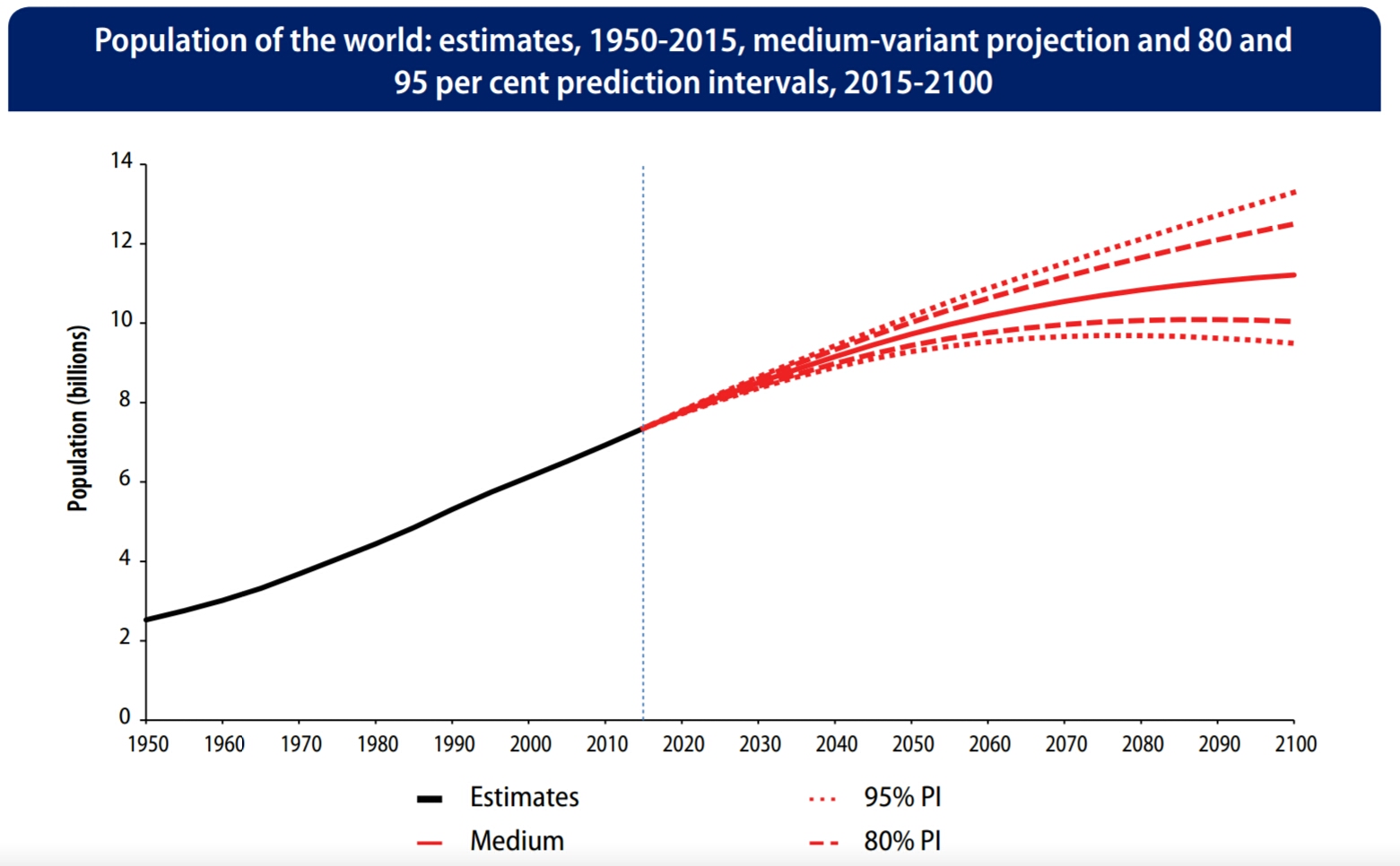

Increasing world population means increasing demand for healthcare services and revenue.

In 1950, total world population was below 3 billion. In 2015, world population was at 7.3 billion, and by 2050, United Nation estimated that world population would be 9.7 billion. For everyone who is alive, regardless rich or poor, one thing that would definitely be required is healthcare services. These can range from vaccines to common cough and flu medication, advanced treatment for complex illnesses such as cancer, or even healthcare facilities for a greying population. An increasing world population will directly lead to increased healthcare spending and revenue.

Have you wondered why the world population is increasing?

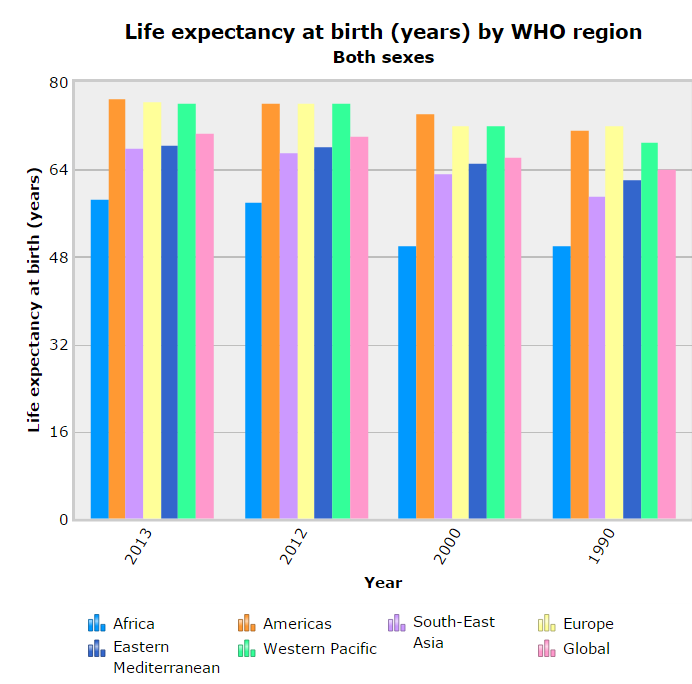

Increased life expectancy

World Health Organisation (WHO) shows that globally, life expectancy is steadily increasing. Every bar chart in 2013 is much higher than in 1990.

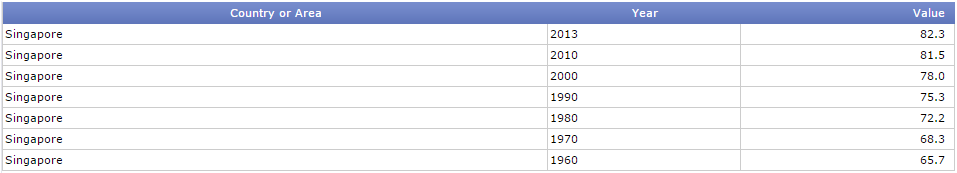

According to UN statistics (table below), Singapore’s life expectancy at birth has increased by 25% from 1960 to 2013.

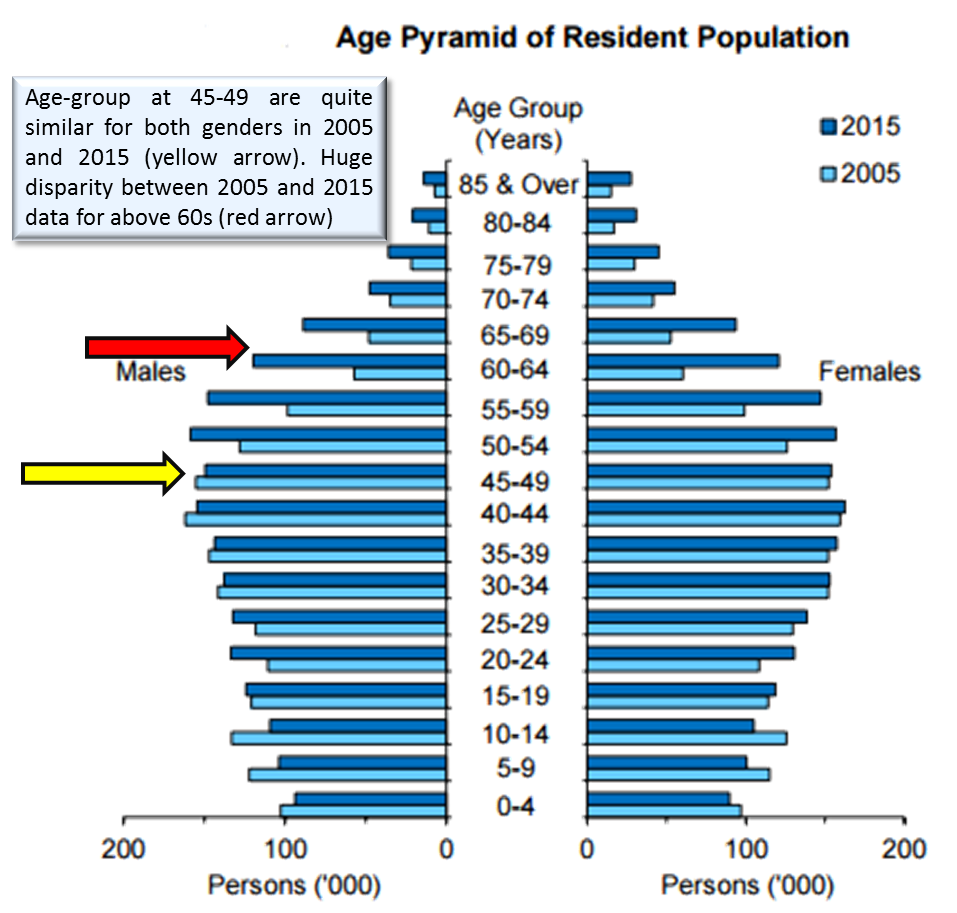

The increase in life expectancy is a result of improvements in public health, food science and hygiene. Refer to the chart by Singstat below. Notice the population with age-group above 60 is significantly lower in 2005 as compared to 2015 for both genders (see red arrow). This means that more people are living past 60s now than in 2005. Both UN and Singstat indicated higher life expectancy as our nation progress.

What if the birth rate is low?

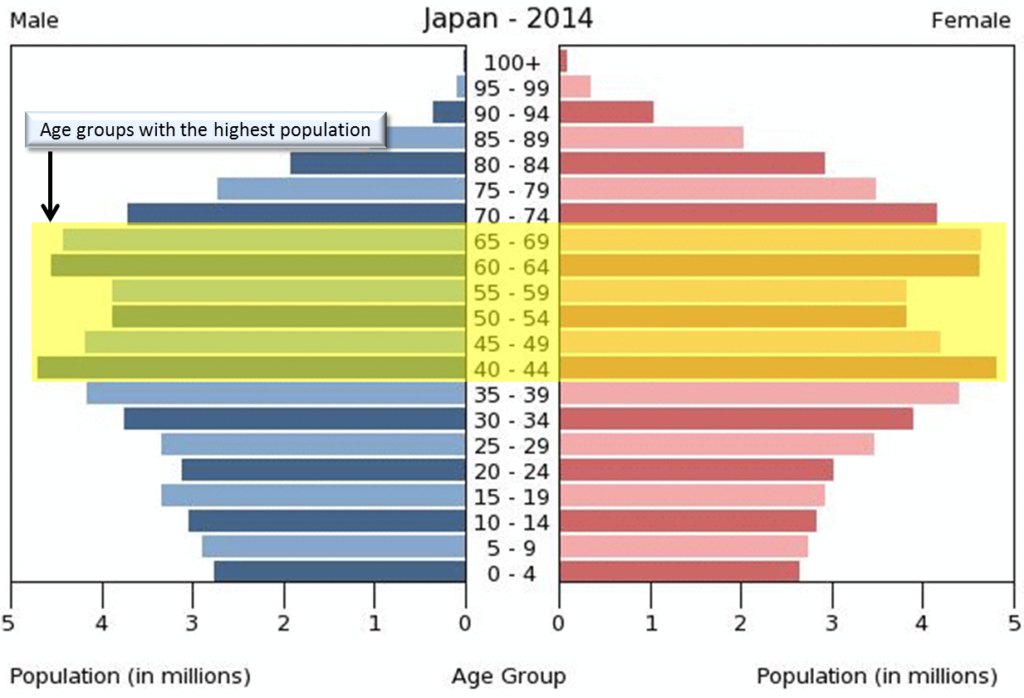

Looking at the same Singstat figure on top, extrapolating this diagram 10 or 20 years ahead, with the assumption of better life expectancy and falling birth rate, we could possibly see an inverted pyramid, where there are more elderly than young. This is not uncommon in a developed nation; Japan is facing an aging population. The biggest population is the age group 40 – 69 (boxed in yellow below). However, this phenomenon is only observed in developed nations such as Japan, Switzerland, Germany, and possibly Singapore.

People are spending more to stay healthy and live longer.

Healthcare services are considered an inelastic demand. When someone experiences a heart attack and requires immediate surgery for bypass, would he check the price and decide to go for the bypass a few years later, waiting for a better price? Certainly not!

We rarely see people scrimp on health care needs if they can afford it.

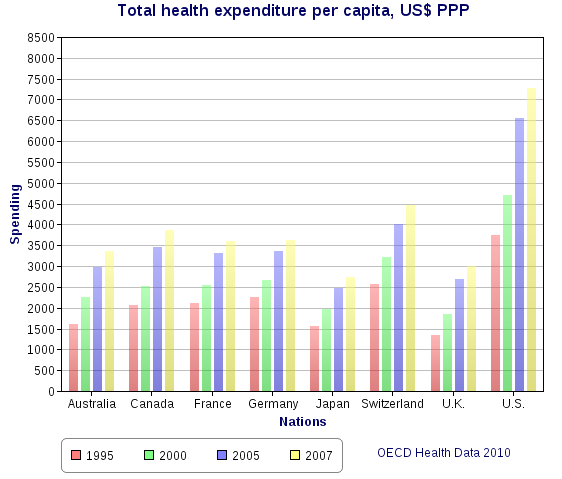

From the chart above and data provided by OECD, you will realise that health expenditure per person and percentage of health expenditure in GDP has increased significantly.

Why is that so?

This is because healthcare services are becoming more expensive due to inflation and because better, more valuable drugs are being developed. And who has forgotten about Mr Martin Shkreli?

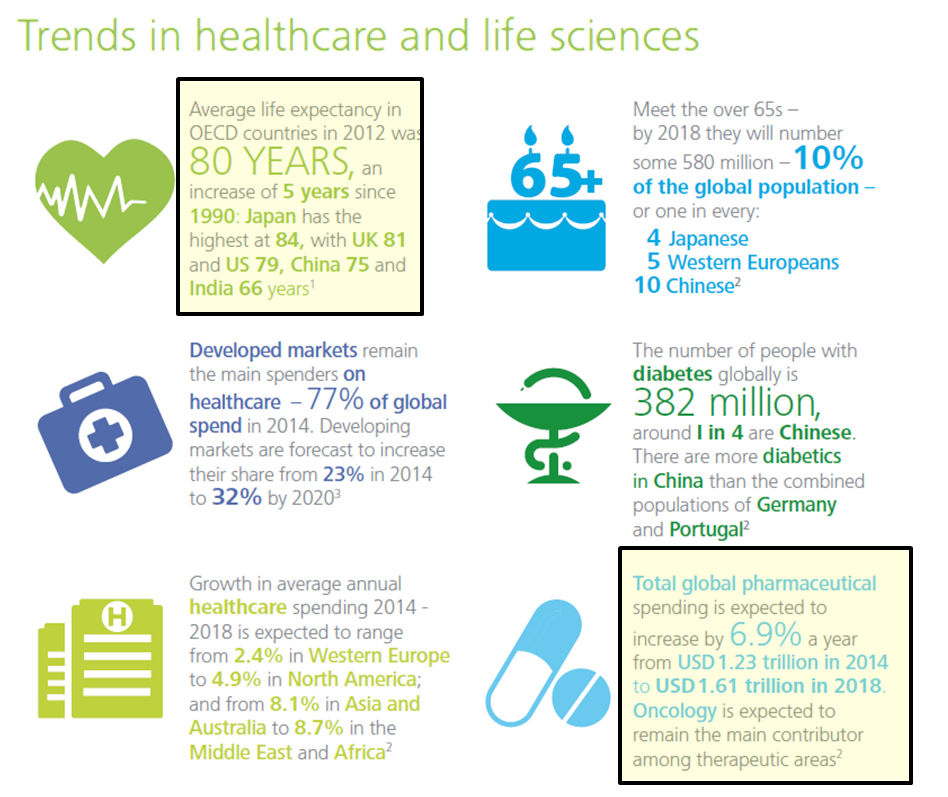

According to Deloitte Centre for Health Solution (below), spending growth is anticipated to accelerate over 6% a year in 2017 and 2018. Total global pharmaceutical spending is expected to hit USD$1.6 trillion by 2018.

Increasing affordability through affluence and universal healthcare programmes

Governments across various nations are aware of this need and have introduced a slew of universal healthcare packages similar to our Medishield. We saw US President Barack Obama and Indonesia’s Joko Widodo roll out their universal healthcare packages. These act as safety nets for those who cannot afford a comprehensive medical insurance. At the same time, society’s increasing affluence sees citizens demand for higher and better quality services (such as going to private hospitals instead of public ones).

As you can see, with inelastic demand, increased affluence and the introduction of universal healthcare packages, the willingness to spend to stay healthy becomes more apparent.

So who will benefit and how?

Healthcare is a HUGE market.

Healthcare Operators

The most direct benefactors from increased healthcare expenditure are the healthcare operators, the likes of government-owned Singhealth (SGH, KK Hospital, etc), Singapore’s Raffles Medical Group (R01.SI), Q&M Dental Group (QC7.SI), Thailand’s Bangkok Dusit Medical Services (BDMS.BK) and Bumrungrad International Hospital (BH.BK) and Indonesia’s Siloam Hospital (SILO.JK). These companies hire doctors to run clinics and hospitals, providing immediate healthcare attention when needed.

Medical Equipment and Services

In order for the healthcare operators such as those mentioned above to run their daily businesses, medical equipment & other auxiliary services are required. Biosensors International Group (B20.SI), Riverstone Holdings (AP4.SI), Hartalega Holdings (5168.KL) and Cordlife Group (P8A.SI) provide cord blood bank, interventional cardiology procedures, cardiac imaging and even gloves to the various healthcare operators.

Medicines and Drugs

Commonly, after a medical consultation, certain drugs or medication would be prescribed. With improved healthcare coverage, people are willing to spend on quality drugs or medicine. Pharmaceutical companies will definitely see a boost in sales. Prominent pharmaceutical companies include Pfizer (PFE), Johnson & Johnson (JNJ), GlaxoSmithKline (GSK), Bayer (BAYN.DE), etc.

Infrastructure: REIT

Last but not least, healthcare operators require a roof over their heads for their operations. This is where the likes of Singapore’s Parkway Life REIT (C2PU.SI), Malaysia’s Al-‘Aqar Healthcare (5116.KL) REIT, Indonesia’s First REIT (AW9U.SI) and Japan’s Nippon Healthcare REIT (TSE : 3308) provide properties to house the healthcare operators and nursing homes. The REIT stands to benefit when operators pay rent to them.

We have concluded the three industries recommended for long term investing. Do you agree with the industries? What are other industries you have observed that would be suitable for long term investing? Please share your comments with us!

If you like our content and think that you have benefited from our sharing, share this article with your friends and ask them to sign up for our newsletter or like us on Facebook.