MTR Corp Ltd (Analysis)

We apologise for the hiatus in our posts.

In our last post in December 2016, we promised to expand our watchlist overseas while continuing to monitor and update our readers on the local stocks in our watchlist. We are delighted to say that we have lined up a series of posts covering Hong Kong’s Mass Transit Railway Corporation Limited (0066.HK), or MTR in short. This is an interesting company with a quasi-monopoly that yields considerable advantage within Hong Kong. Without further ado, let’s look at what MTR does.

World’s Most Profitable Railway Operator: MTR Corp Ltd (Analysis)

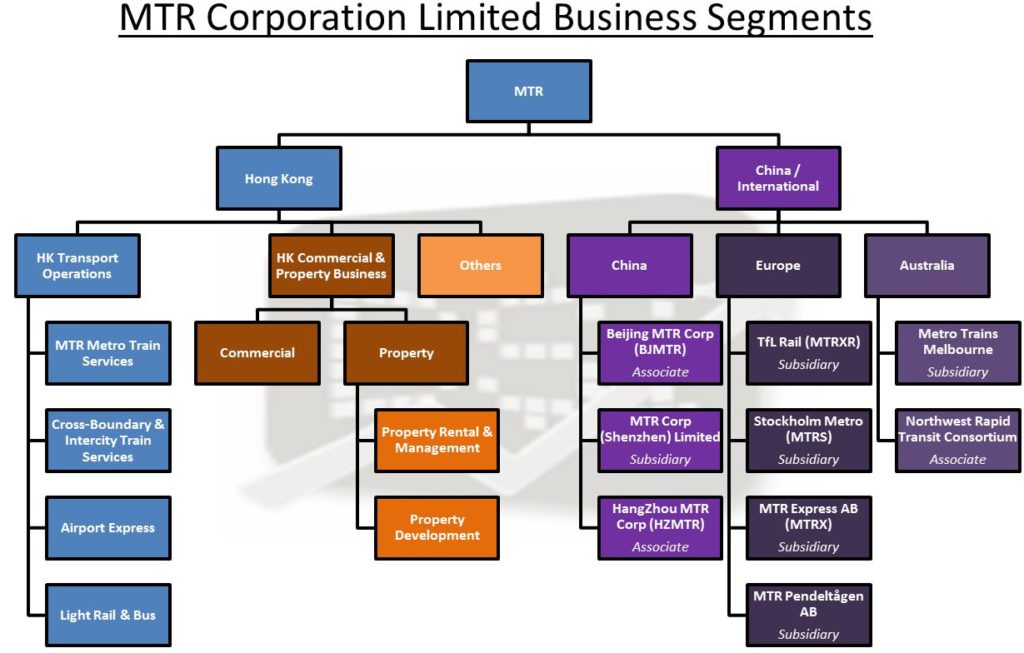

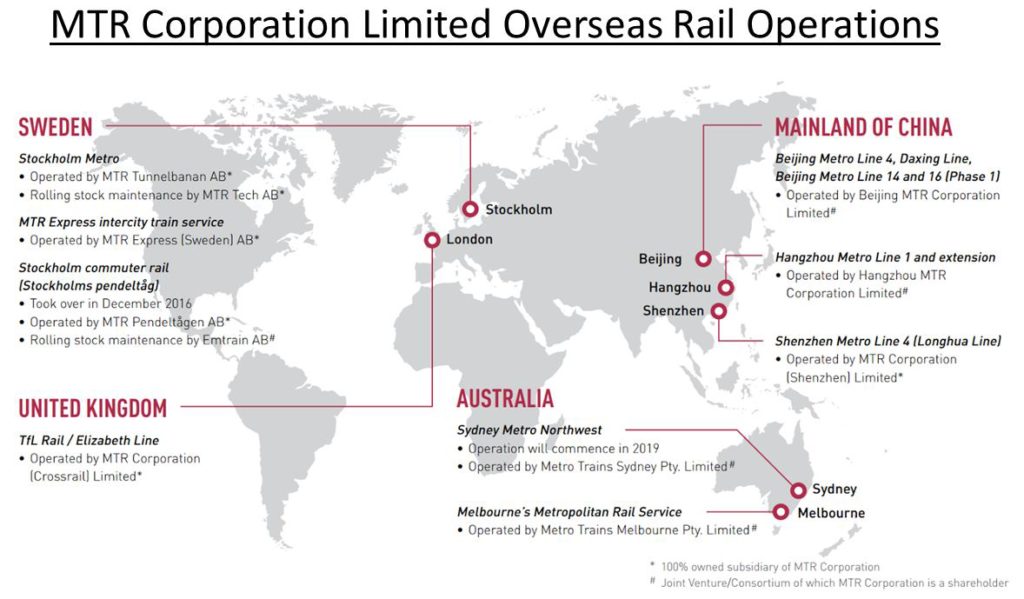

MTR is a company listed on the Hong Kong Exchange and is a constituent of the Hang Seng Index. The world’s most profitable railway operator runs the Hong Kong MTR metro system, and is also a major property developer and landlord there. Adopting an asset-light model for its overseas business, MTR bids for concession contracts to build, operate and maintain railways in different parts of the world, including London, Stockholm, Beijing, Shenzhen, Hangzhou, and Melbourne. See the diagrams below for its business segments and the map of its overseas rail operations.

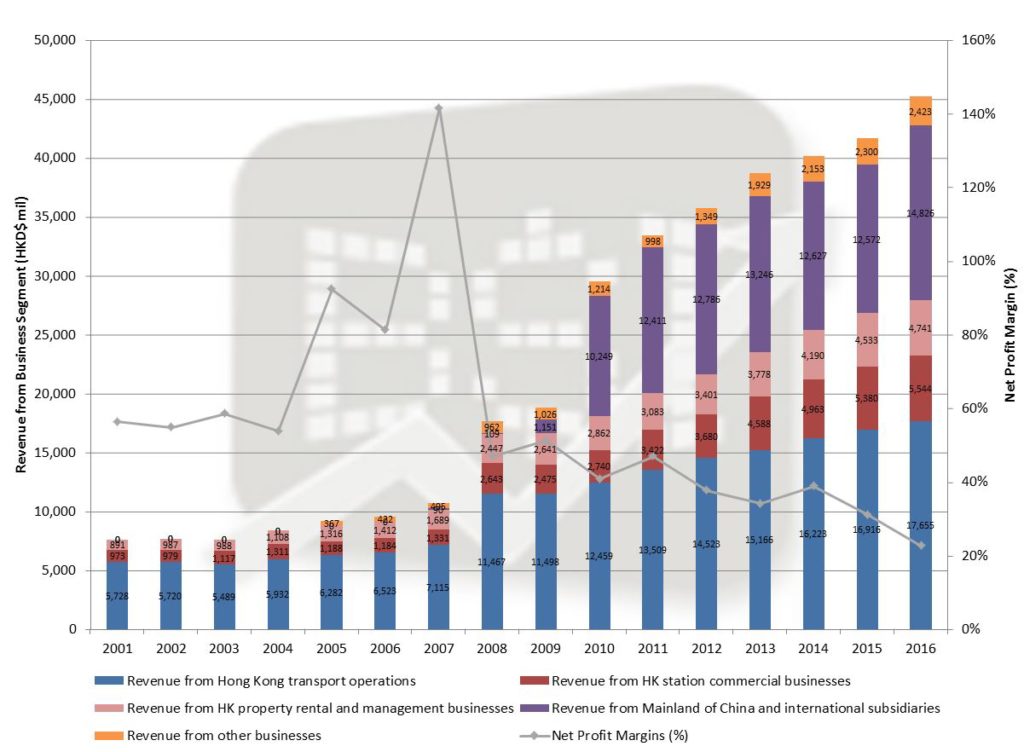

MTR’s Profitable Growth

Figure 1 shows MTR’s earnings from 2001-2016. The earnings chart breaks down the revenue into its various business segments (less Hong Kong’s Property development) and detailed its net profit margins over the years. The combined revenue quadrupled from HK$7.5 billion in 2001 to HK$45 billion in 2016, that’s a compounded annual growth rate (CAGR) of 11%!

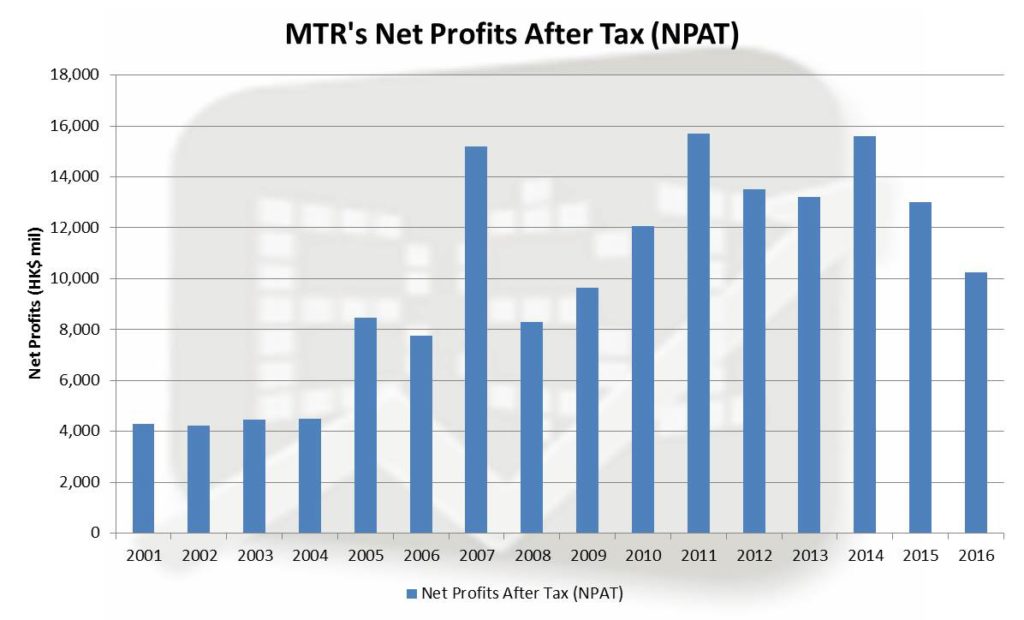

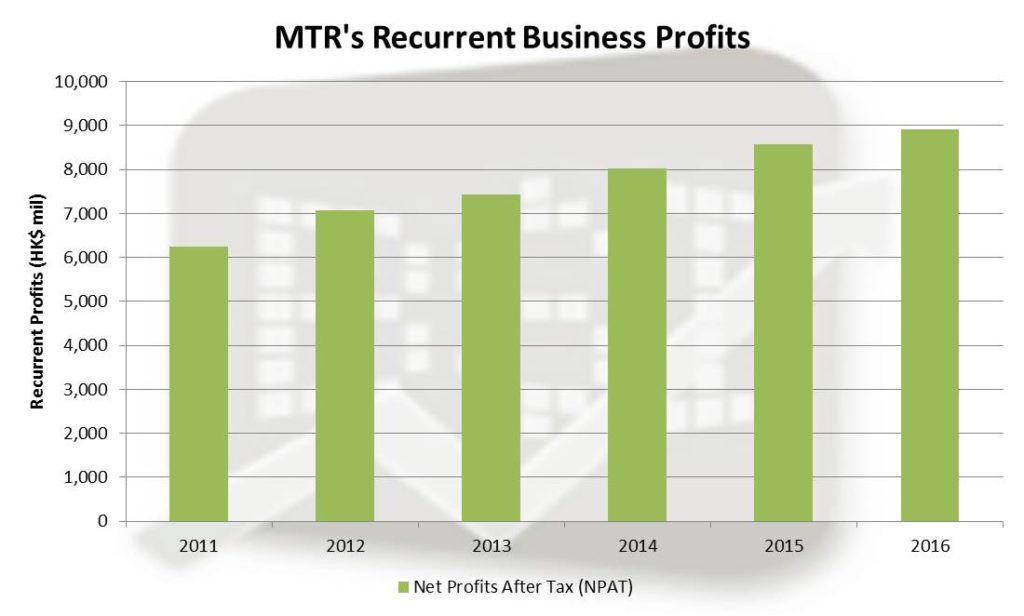

Figure 2 below shows MTR’s net profit over the 16 years since IPO. Due to the nature of its property development, the net profits were lumpy. However, net profit had still grown considerably from HK$4 billion in 2001 to HK$10 billion in 2016, a 6% CAGR. Stripping the lumpiness of its property development segment away, Figure 3 shows MTR’s recurrent business profits from 2011 onwards. You will realise that its recurrent business had been growing steadily from HK$6 billion in 2011 to HK$8 billion in 2016. Coincidentally, that is also a CAGR of almost 6%!

The net profit margins for MTR is currently at a very reputable 22%, although it is experiencing slight decline over recent years.

MTR’s Dividend Growth

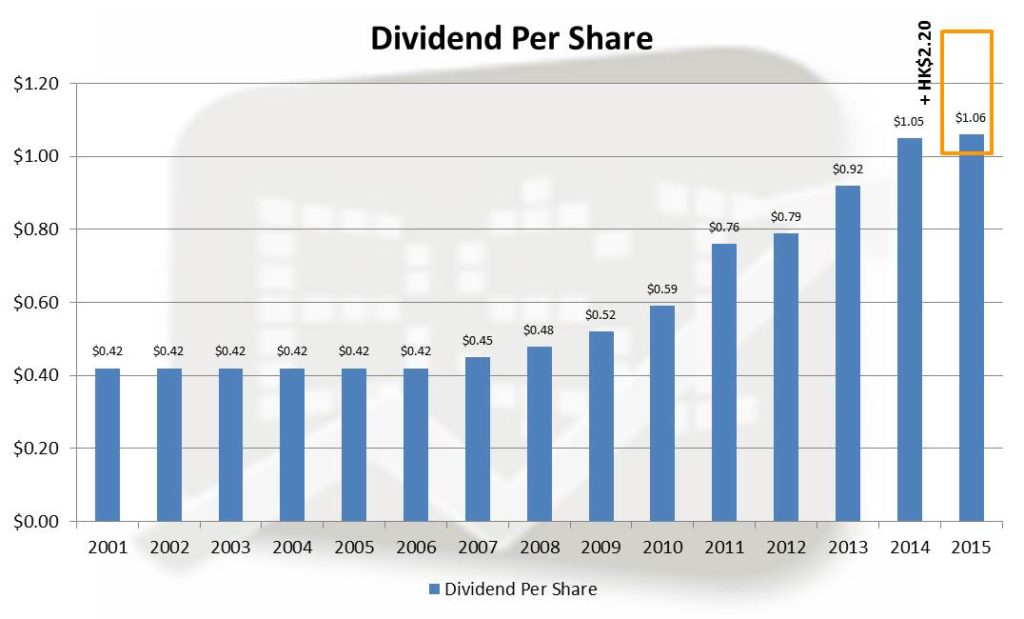

MTR has seen its dividend increase from $0.42 in 2001 to $1.06 in 2016, approximately 6% CAGR over the years. However, note that in the fiscal year of 2015 and 2016, special dividend of HK$2.20 would be given out per year due to the Express Rail (XRL) Agreement. The special dividend for FY2016 would be given out in the second half of 2017. Assuming the annual dividend stayed the same at HK$1.06, you would be receiving HK$3.26 per share. That would be a 7.3% dividend yield! If you had invested last year, you would have safely taken back about 15% of your money invested and still be sitting on a decent 20% capital appreciation since October 16.

But hold your guns. Please do not rush out and start buying MTR as the dividend is only for the 2 years mentioned above. After that, it would be normalised to a decent ~2.4% yield. Let’s try to better understand the business of MTR before deciding if it is an attractive company to invest.

Stay Tune for more MTR articles!

In the next few articles, we will break down MTR’s operating segment and study them in detail to understand MTR’s competitive advantage and how it commanded such respectable growth and margins.

Firstly, we will share why MTR’s transport operation has a competitive advantage in Hong Kong; to allow it to become the nation’s most preferred mode of transport. We will also share on what its future rail prospects are.

Next we will explore MTR’s second competitive advantage, which allows it to command above 80% of gross profit margins in its property business.

We will also cover its overseas rail and property operations and compare MTR’s key metrics with some of the listed peers in the region. With the “One Belt, One Road” Initiative and its existing dealings with China, MTR seems to be poised to benefit from the new Silk Road.

If you like the upcoming articles, do like our Facebook page or sign up for our newsletter!

Note: Byte Sized Investments has vested stakes in MTR.

If you are into investing and like to know what the gurus think of the market right now, here’s one event coming up that YOU SHOULDN’T MISS: InvestX Congress. It’s an event for retail investors like you and me to gather to learn what’s working NOW in the investment world… it’s not about theory; everything’s “Been there, Done that”. Don’t hesitate, click here to get your tickets NOW!