Your Bite-Sized Guide to CPF LIFE

In our bite-sized guide to CPF LIFE, we will introduce what CPF LIFE is about. In the following article, we will share how you can maximise it to your advantage.

So what is CPF LIFE?

The LIFE in CPF LIFE stands for Lifelong Income For the Elderly. It works like an annuity where a sum of money is constantly paid to you, on a monthly basis for the rest of your life.

Why was CPF LIFE created?

Before answering that, we must first understand why CPF was created. CPF was conceived as a “mandatory saving plan” to ensure Singaporeans set aside a sum of money for retirement. After retiring, they can use this amount to fund their living expenses. However due to inflation and better health care, Singaporeans are outliving the sum set aside in their CPF. The government realised that CPF was no longer able to serve its purpose as a safety net for retirement. Hence CPF LIFE was created to ensure Singaporeans receive a steady stream of income to sustain their retirement.

How does it work?

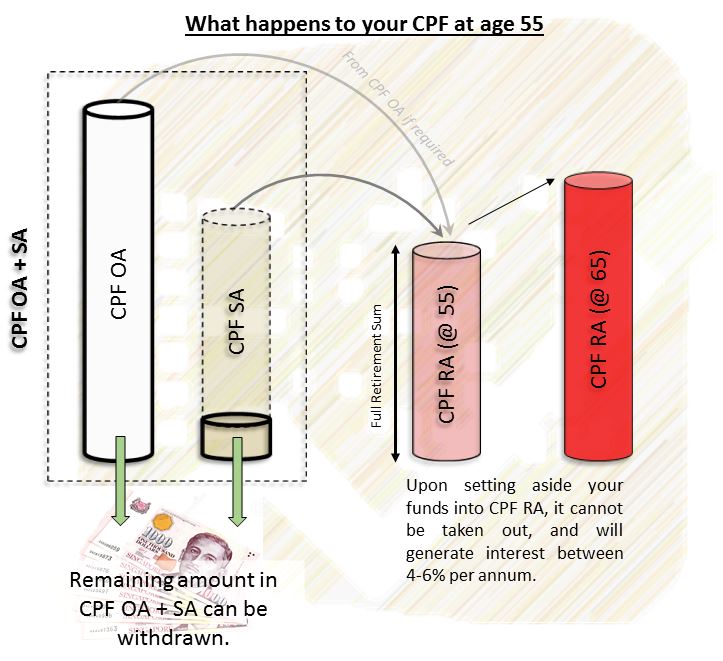

At age 55, you would have accumulated some monies in your CPF Special Account (SA) and Ordinary Account (OA). CPF would set aside a sum of money (called the Full Retirement Sum, or FRS in short), from your CPF SA and OA into your CPF Retirement Account (RA). How much is this sum?

According to CPF, 2017’s FRS is S$166,000. FRS will adjust to keep up with inflation (CPF has published the FRS for 2020).

After setting aside the FRS* into your CPF RA, you may (1) leave it to compound at the prevailing 2.5% and 4% rates (correct as of August 2017) OR (2) withdraw the remaining amount left in your OA and SA as cash at any time.

*Note: If your combined CPF OA & SA at age 65 is less than S$5,000, you do not need to set aside money into your CPF RA. You are allowed to withdraw everything out.

Funds that are set aside in CPF RA cannot be drawn out. The first $30,000 in your RA would compound at 6%, the next $30,000 would compound at 5%, and the rest of the monies in the RA would compound at 4% interest.

Thus (from 55-65), you would have decided how much money you to withdraw, how much to set aside in your CPF RA, and allow the money to compound. So what happens from age 65 onwards?

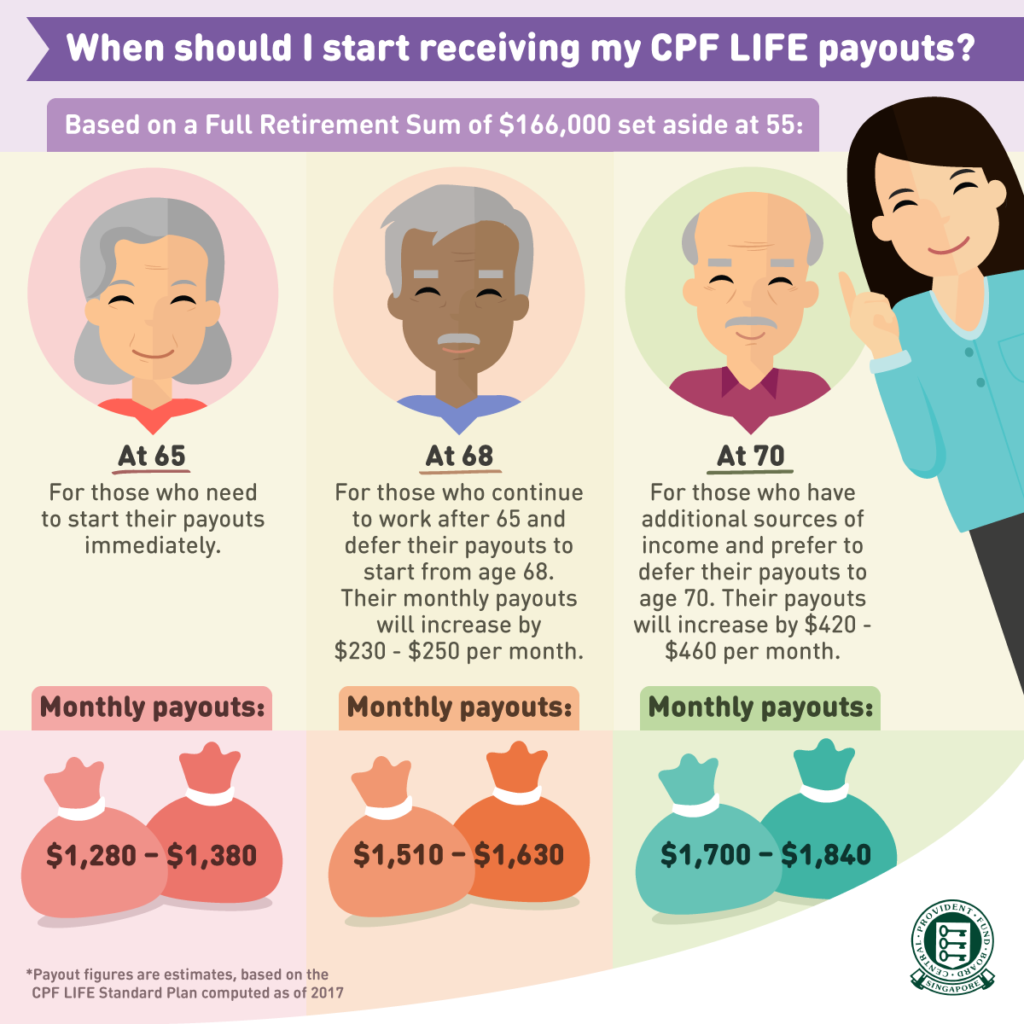

When can I commence my CPF LIFE Payout?

At any point between age 65 to 70, you can choose to commence your CPF LIFE monthly payout. Choosing to delay LIFE payout commencement date will yield higher monthly payout as shown in the diagram below.

Choosing CPF LIFE Plans

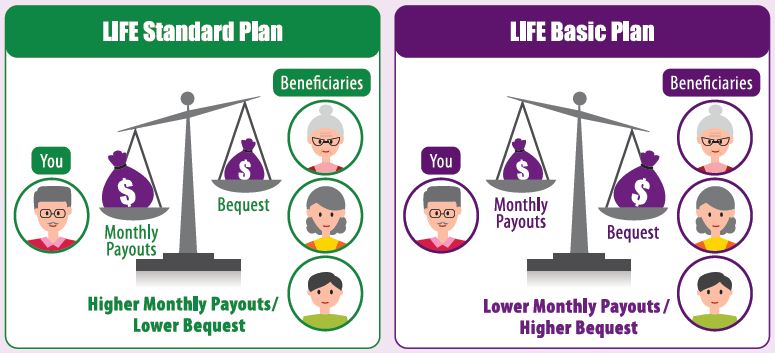

Before commencement of the LIFE payout, you can either opt for LIFE Standard plan where you get a higher monthly payout, but with lower bequest for your loved ones; or LIFE Basic plan, where you get a lower monthly payout and a higher bequest amount set aside for your loved ones (see diagram below). The monthly payout is dependent on the amount of your CPF RA at the commencement of LIFE payout. CPF has announced that they would also be introducing another plan that has escalating payout.

Varying CPF Retirement Sums to offer flexibility

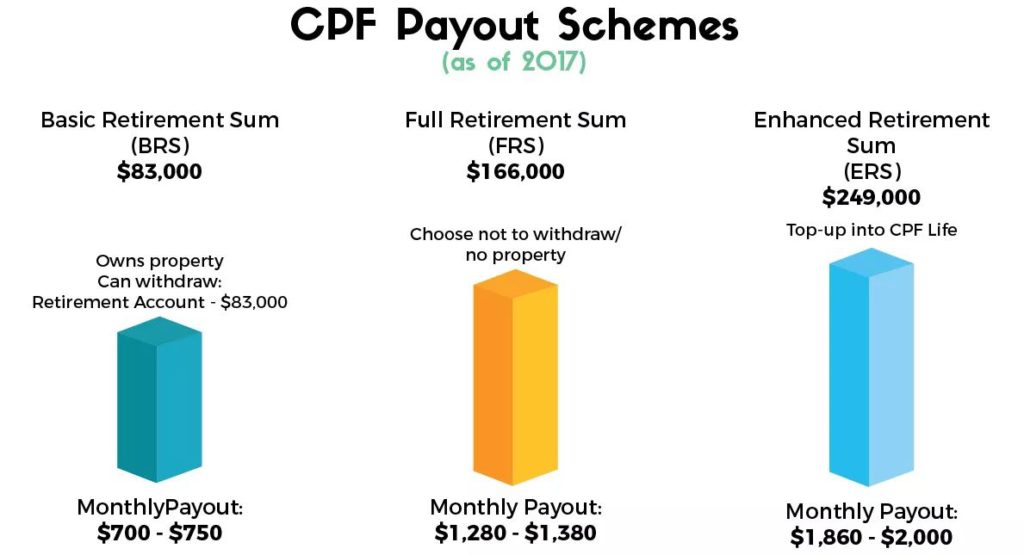

To cater to varying cash needs for members, CPF allows other sums to be set aside. If you need more cash at age 55, you may pledge your property to CPF and withdraw the remaining amount in cash after setting aside the Basic Retirement Sum (BRS). If you want a higher payout from CPF LIFE, you can choose to set aside a higher sum than the FRS. However the upper limit that you can set aside into your RA is at the Enhanced Retirement Sum (ERS), which is S$249,000 in 2017. The diagram below shows how much monthly payout you will receive if you selected the Standard Plan after setting aside the respective retirement sums.

Note that the sums set aside are not discrete amounts, but a continuous ones; meaning you can set aside any amount between $83,000 – $249,000 and receive a payout between $700 – $2,000.

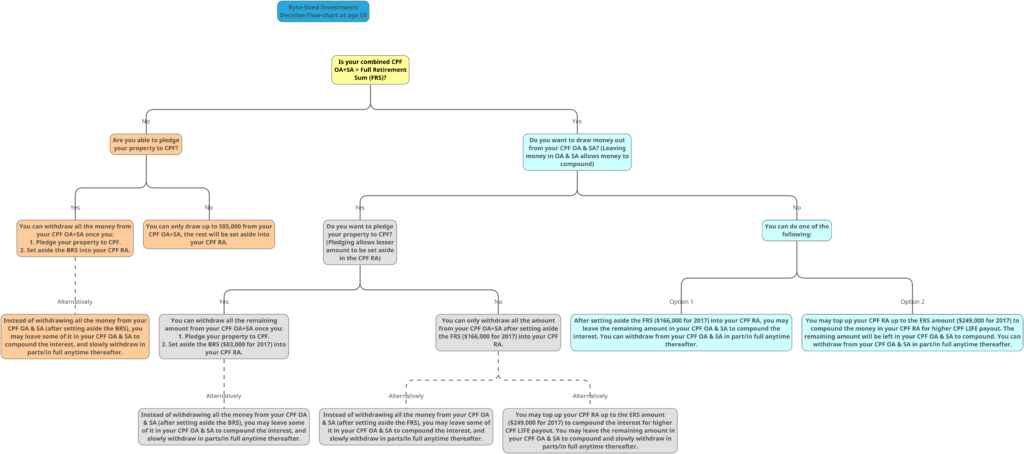

The diagram above is a flow-chart to guide you on what you can do for your CPF when you hit the age of 55 years old. You can download a copy of the PDF with better resolution here.

We hope this bite-sized post helped you to better understand what CPF LIFE is. In our next article, we will share 2 simple facts and show you can maximise CPF for your retirement.