DBS: 1Q16 net profit rises 6% to S$1.20 billion

DBS 1Q16: The tale of two stories.

“DBS first-quarter net profit rises 6% to S$1.20 billion”

“DBS Q1 net profit slips 5%”

If you owned DBS share, how would you had reacted if you read the headlines?

Aren’t they conflicting? Are the news releases from reliable sources? One was from DBS, the other was from Business Times. Were the parties biased? Which headline provided investors accurate information? How do the headlines change one’s initial response? Would the outcome be different if the investors had read in depth and detail? So is the glass half full, or half empty? Food for thought…

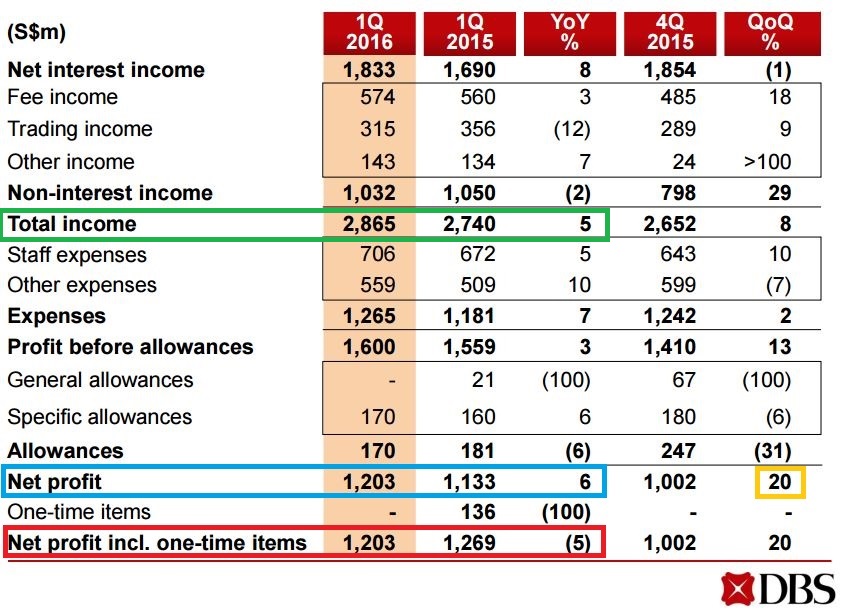

Back to the all important news release, DBS Group achieved 1Q16 net profit of S$1.20 billion. Excluding one-time items in prior periods, the earnings were a record and 6% higher than a year ago (blue box). Total income also reached a new high, rising 5% to S$2.87 billion (green box) as net interest income grew 8% to S$1.83 billion.

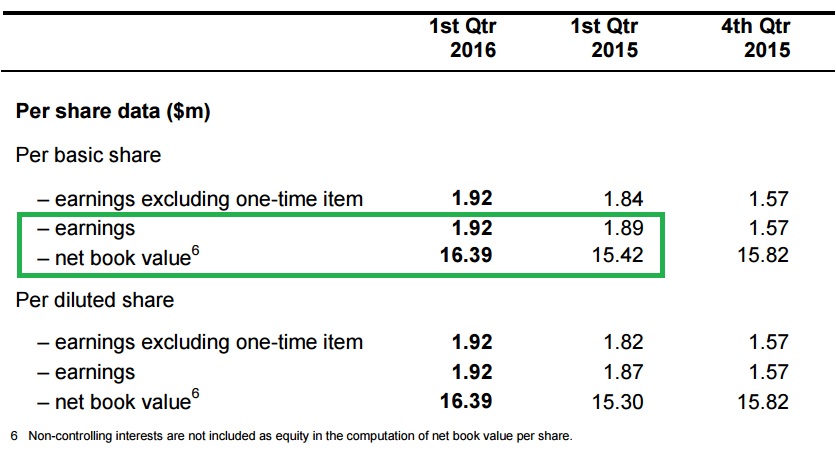

As you know, net profit including one-time items caused a 5% decline in net profit (red box above). Despite that, per share data improved. Interestingly, as of 3 May 16, DBS closing share price was S$15.35 while net book value was S$16.39.

So what was this one-time item? Referring to 1Q15 earnings release, it was a disposal of a property investment in Hong Kong (page 3).

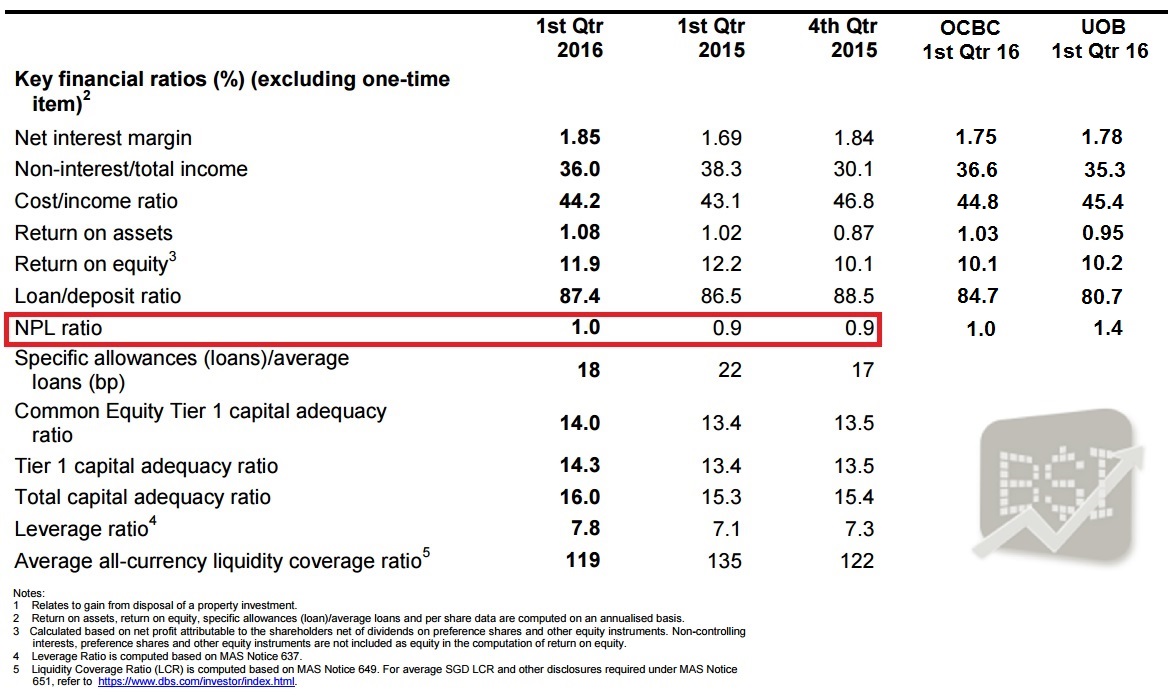

According to DBS, asset quality continued to be sound. The non-performing loan (NPL) rate rose slightly to 1.0% (red box below) while specific allowances increased 6% to S$170 million. Allowance coverage of non-performing assets remained healthy at 134% and at 286% if collateral was considered. You may compare these ratio with OCBC and UOB below.

Return on equity (ROE) was 11.9%, while return on assets (ROA) was at 1.08%. Comparing with OCBC and UOB, DBS demonstrated an edge over its peers, as it continued to be nimble in capturing opportunities and rigorous in managing risks in a challenging operating environment.

OCBC reported 14% dip in 1Q16 net profit year-on-year due to lower insurance income and increase in allowances. OCBC overall NPL ratio was 1.0%, as compared with 0.9% of the previous quarter and 0.6% in 1Q15, this was a similar NPL that DBS factored in 1Q16.

At the same time, UOB reported 4.4% decrease in net profit year-on-year, attributable to lower wealth management fees and trading and investment income. Its NPL ratio as at 31 Mar 16 was 1.4%, while NPL coverage was high at 133.2%, and 325.3% after taking collateral into account.

DBS also has a higher Net interest margin (NIM), lower Cost/income ratio compared to its peers.

DBS CEO Piyush Gupta said, “While we have had a succession of record earnings, this quarter’s performance is particularly satisfying because it was achieved in unusually challenging market conditions. We are proud of the depth and quality of the franchise we have systematically built over the past few years. Our continuing investments in regional businesses and efforts to reinforce risk management, together with a robust balance sheet, put us in a strong position to continue supporting customers and delivering consistent shareholder returns.”

To receive regular bite-sized finance news, sign up on our blog or like us on Facebook.

Note: Byte Sized Investments has vested stakes in DBS