FIRST REIT: 2Q17 Financial Results

First REIT has released their 2Q 2017 financial results on 17 Jul 17.

The key highlights and corporate developments are as follows:

- DPU up 1.4% to 2.14 Singapore cents compared to 2.11 Singapore cents in 2Q 2016

- Distribution to Unitholders rose 2.5% to S$16.6 million compared to S$16.2 million in 2Q 2016

- Retirement of Dr Ronnie Tan as CEO of Bowsprit after 10 years at the helm

- Re-designation of Chief Financial Officer, Mr Victor Tan to Acting CEO of Bowsprit and Executive Director of the Board

- Appointment of Mr Carl Gabriel Florian Stubbe as Non-Executive Non-Independent Director of the Manager, and Chairman of the Board

- Appointment of Mr Tan Chuan Lye as Lead Independent Director of the Board

First REIT Financial Results

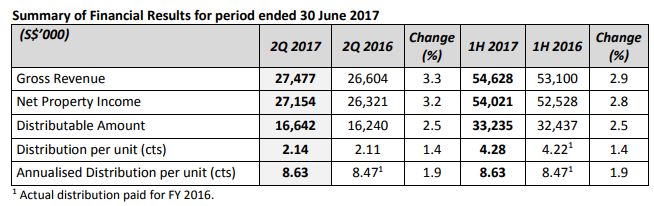

Quarter on quarter, gross revenue and net property income increased 3.3% and 3.2% respectively resulting in a 2.5% rise in distributable amount, from S$16.2 million to S$16.6 million. This translates to a DPU of 2.14 Singapore cents compared to 2.11 Singapore cents a year ago. The increase was due to the contributions from Siloam Hospitals Labuan Bajo (“SHLB”) as well as higher rental income from existing portfolio.

Gearing

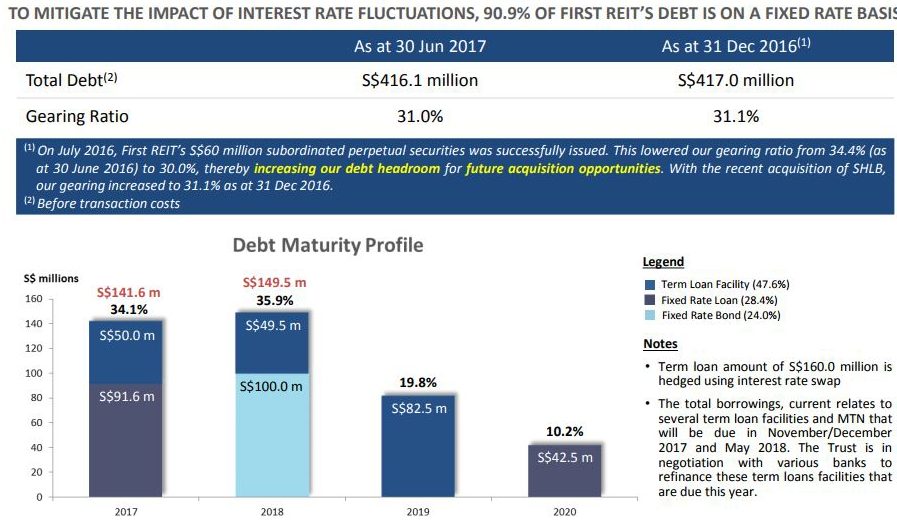

Its total debt stands at S$416 million giving First REIT a gearing of 31%. This was after the issuance of S$60 million worth of perpetual securities in June 2016, giving its perpetual securities holder 5.68% interest per annum. 34.1% of the debt would be due for refinancing this year. 70% of First REIT’s debt would be due for refinancing in the next 2 years! With interest rates hike occurring this should be one aspect we should be taking a close look at. Drop us a comment if you would like to know how much 1% interest rate hike would affect First REIT?

Dividends

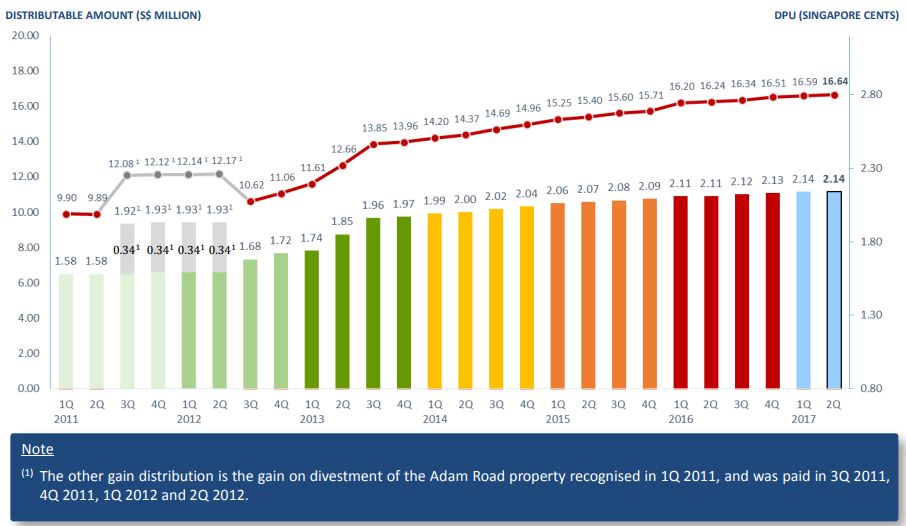

Investors invest in REIT for its consistent dividends. First REIT has been offering increasing dividends over the years, supported by increasing distributable income (denoted by the red line). First REIT generated S$25 million in operating cash flows (2016: S$24 million), showing that the distributable income that generates the dividends to sustainable. First REIT dividend payout date would be on 28 August 2017, dividends to be paid in cash; no scrip options. We read that the lack of scrip options this round could mean that there is no immediate need for cash.

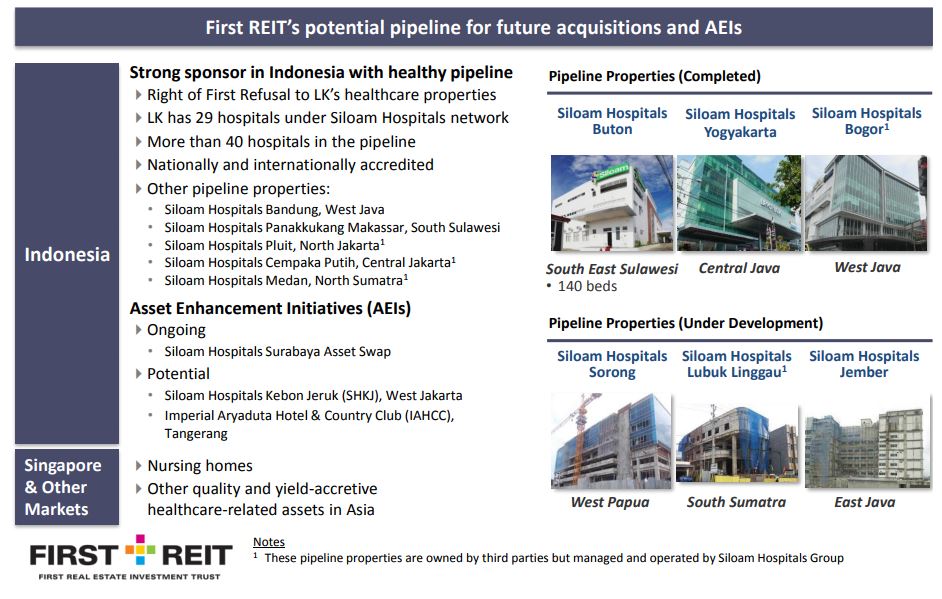

Net property income and distributable income have slowed down compared to previous years due to the slowing of new acquisitions. It was noted that First REIT’s management will continue to look for yield-accretive acquisitions to maximize shareholders’ returns. They sponsor is PT. Lippo Karawaci Tbk., which has a visible strong pipeline of 44 hospitals. Last year, First REIT made announcements of potential joint venture on Siloam Hospital Yogyakarta with Lippo Malls Indonesia Retail; the plan has been delayed.

To receive regular bite-sized finance news, sign up on our blog or like us on Facebook.

Note: Byte Sized Investments has vested stakes in First REIT.