The difference compounding interest can make to your CPF SA

Today, we shall explore the other effects of the cash top up into your CPF SA: compounding interest.

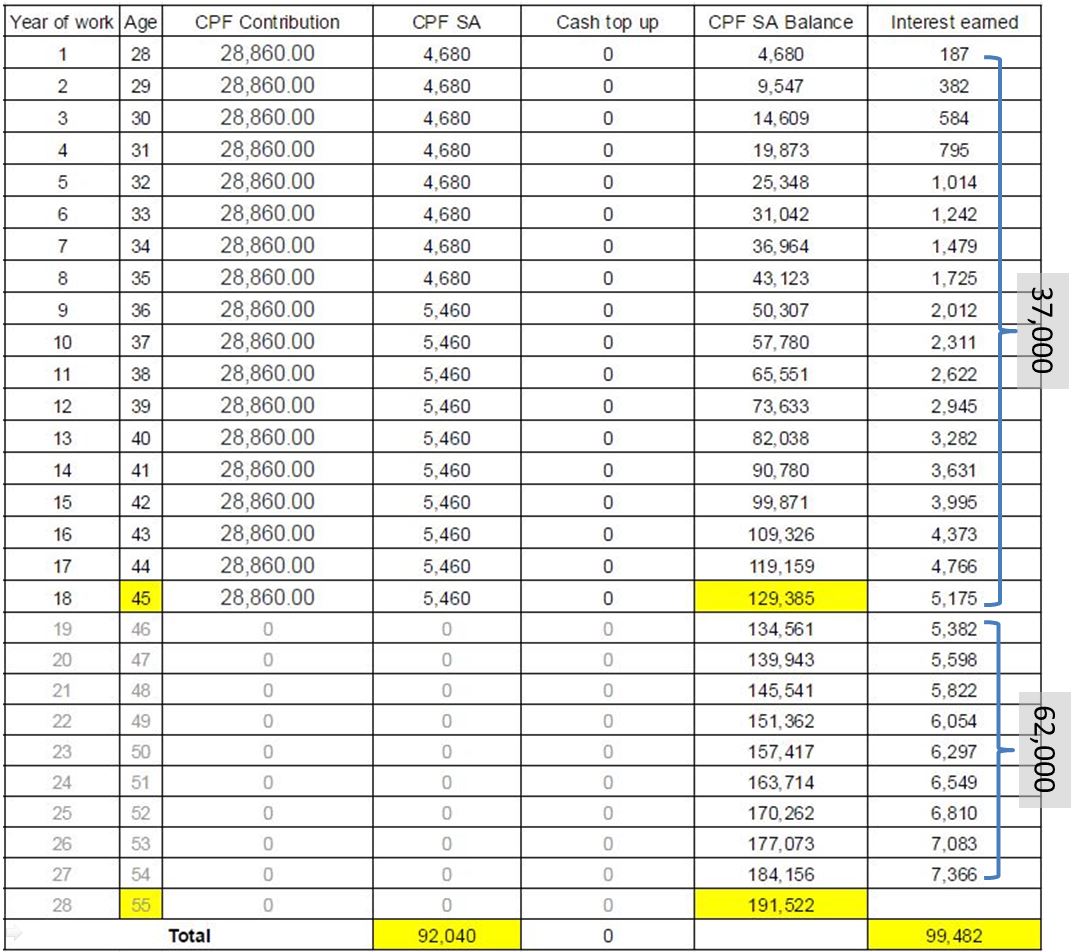

Scenario #1: No CPF Cash Top-up. Total interest accrued at age 55: $99,000

Recall Jack, our 28-year-old example who earns $78,000 annually, contributing a total of $28,860 into his CPF, of which about $4,680 goes into his CPF SA (click here for a more detailed post on the contributions).

For simplicity sake, Jack worked for 18 years; his salary stayed stagnant throughout those years. He then stopped work at age 45. By then, he would have contributed around $92,000 from his salary. His CPF SA balance would be around $129,000, with the additional $37,000 accrued from interest!

* CPF SA contribution increased from 6% to 7% after age 35. See link for the calculations on contributions.

Thereafter, without any further contributions, as the CPF SA monies continue to compound at 4% per annum. By age 55, the value of his CPF SA would have grown from $129,000 to $191,000. Jack added an additional $62,000 in the 10 years of retirement without doing anything! Adding the $37,000 interest earned previously, total interest sums up to $99,000. Doesn’t it sound good to have an additional $99,000?

Well, honestly, it could be better!

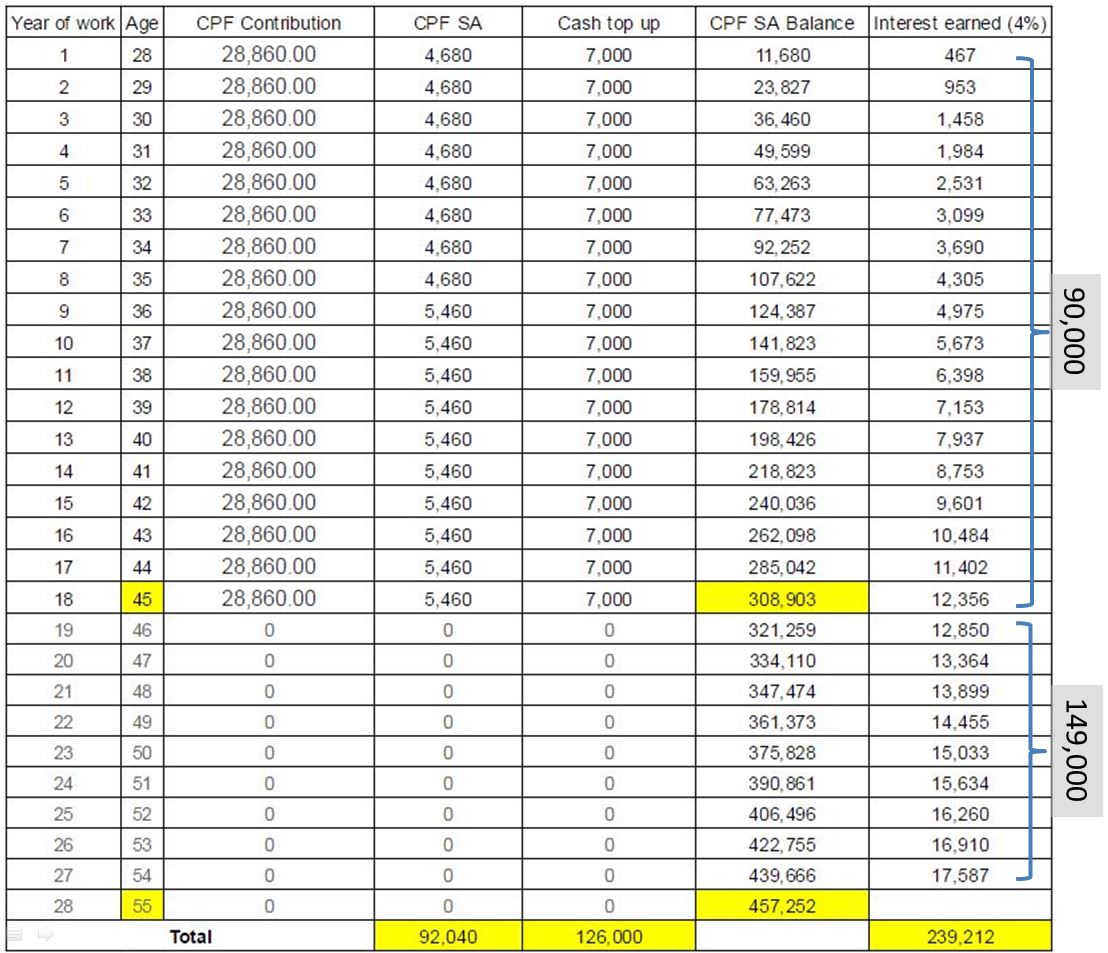

Scenario #2: With $7,000 CPF Cash Top-up. Total interest accrued at age 55: $239,000

Let’s say at the end of the year, Jack at age 28, planned his finances and cashflow properly, and managed to spend within his means. He sees his spare cash idling in the bank which earns a measly 0.05% or 1.8% if he put them into a fixed deposit. So he thought to himself, why not contribute another $7,000 into his CPF SA? It can save him about $500 in tax and earn an additional $280 bonus interest a year.

Similarly, for simplicity sake, his salary stayed stagnant and he stopped work at age 45. Like before, he would have contributed $92,000 from his salary and an additional $126,000 via his cash top up, yet the value in his CPF SA stands at $308,000 at age 45. That is $90,000 more than he had contributed.

Without increasing any contributions, allowing the CPF SA to compound at 4% per annum till age 55, the value of his SA would be at $457,000! That is an additional $149,000 of interest accrued for 10 years without any additional contribution!

To put it in perspective, he contributed $218,000 in 18 years, yet by age 55, the interest accrued was a whopping $239,000! That is a return of 110%! Jack’s CPF is effectively doubled!

This is the power of compound interest. 🙂

Note: If CPF SA has met the Full Retirement Sum (limit), you will not be able to contribute any more via CPF cash top-up, but you will still be able to continue to accrue interest.

Another note: In reality, the CPF contributions and interest accrued would be greater as in most cases, salary grows.

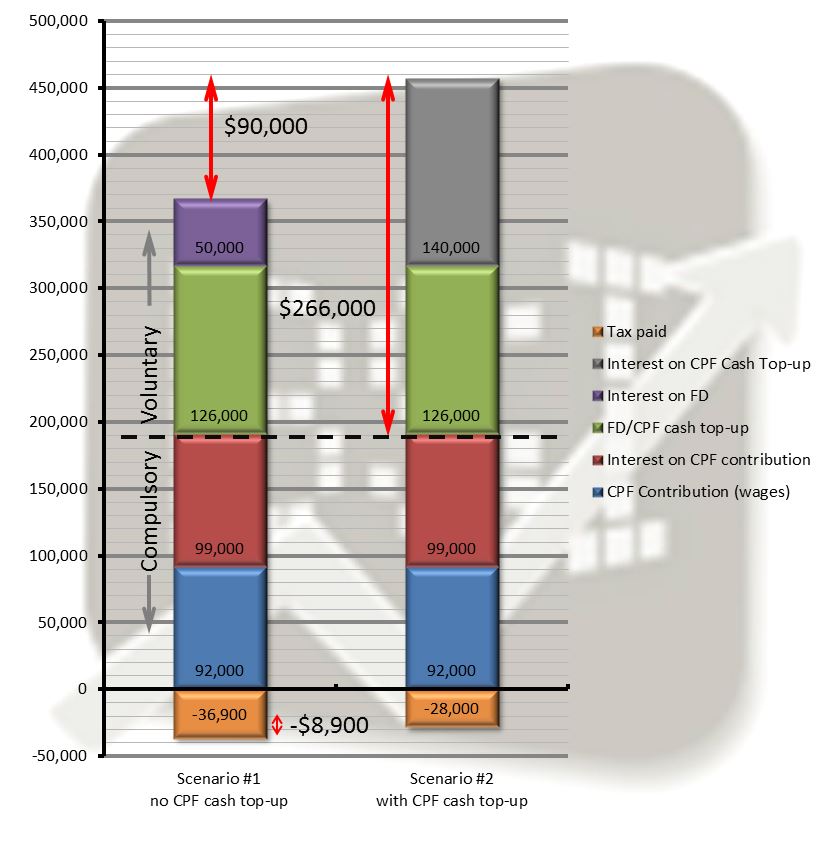

Here’s a simpler comparison on the CPF and savings.

Let’s summarise the difference. Refer to the bar chart below. On the left bar, it is Jack’s savings in CPF & savings if he did not contribute the additional CPF cash top up, on the right, is Jack’s savings in CPF with CPF cash top up.

To keep the comparison fair, instead of contributing a yearly $7,000 CPF cash top up from age 35 to 45, Jack saved the money in a fixed deposit with hypothetical interest of 1.8% (perhaps one of the best fixed deposit interest rates available currently). The fixed deposit compound at 1.8%, at age 55, the total interest earned after $126,000 of contribution would be around $50,000.

Let’s see how the 2 scenarios pan out.

Both would have contributed $92,000 of CPF through wages and earned an interest from CPF contributions of about $99,000 over the 28 years (denoted by blue & red bars respectively). Similarly, whilst one deposit $7,000 into fixed deposit (on left), the other did a yearly $7,000 CPF cash top up for 18 years, this comes to $126,000 (denoted by the green bar). This is where the similarity stops.

The fixed deposit (purple) will compound to earn an interest of about $50,000 while CPF, with a 2.2% interest higher than the fixed deposit, earned an interest of $140,000 (grey). This is almost a $90,000 difference!

At the same time, recall the tax savings? Based on the above scenario of stagnating salary, without CPF cash top up, Jack would have paid taxes up to $36,900 over 18 years (orange). If he did the CPF cash top up, he would had paid only $28,000 of taxes over the same period. That is almost a $8,900 difference!

The total difference on interest earned and tax savings is actually…a staggering $98,900!

Don’t forget, if Jack spent the money away, instead of voluntarily putting those yearly $7,000 into CPF SA or fixed deposits, the difference of the combined interest earned, top-ups and tax saved would be $274,900.

Power of Compounding and Prudency: A $275,000 decision!

In our previous article, we shared one important consideration was the ability to balance one’s lifestyle yet still has the cashflow to contribute the CPF cash top-up. If Jack has high living expenses, such as paying off home and car loans, frequent fine dining and holidays, etc, then he might not be able to afford this top-up, a very costly $275,000 decision.

As putting money with CPF SA is long term decision. Once in, the money cannot be taken out. Thus, Jack needs to ensure that he must have his emergency funds properly built up before he considers topping up his CPF SA.

By doing this simple contribution, when Jack retired at age 45, he has close to half a million in his CPF SA by age 55, and $680,000 at age 65. In fact, this could be the way to go for employees who earns a decent income, manage their budget prudently, does not wants to get involved with investments and have certain trusts in CPF.

Other considerations on such long-term commitments

Of course, one would worry about the government’s never-ending upward revision of the retirement age, or the inexorable increase in CPF’s Full Retirement Sum (FRS), or the possible change in the interest rates on CPF SA. In the worst case, query the government’s ability to return CPF monies to account members.

We would be covering these considerations in one of our future blog posts. Like our Facebook page or sign up for our newsletter to receive the notifications!

PS: We thank Trey for pointing out our mistakes on the CPF SA Contributions, which was 6% of wage instead of 6% of CPF contributions. We have updated our figures.

![Why you should start investing, even as an employee [Part 2] medium 360x240 - Why you should start investing, even as an employee [Part 2]](https://www.bytesizedinvestments.com/wp-content/uploads/2015/10/medium-360x240.jpg)