How you could have made 10% in 3 days!

Some days back, I wrote an article on using share buybacks as references to capitalize on stock market crashes.

So what is share buybacks?

Also known as “share repurchases”, share buybacks occurs when a listed company buys its own shares from the stock market. You can see it as the company re-investing into itself. When shares are repurchased, the number of outstanding shares in the market are reduced. This causes each investor’s stake to increase, as there are now fewer shareholders owning the company. A simplified diagram is shown below.

Source: BSI

When the share buybacks are done, the shares are usually kept as Treasury shares, or permanently cancelled to reduce the shares outstanding.

Why are share buybacks beneficial?

A good management is supposed to allocate capital to maximize returns for their shareholders. They can use the capital to expand their operations, invest in other businesses (by acquiring them), or invest in themselves (share buybacks). Management would usually have a good knowledge about what’s going on within the company and have a good sense of its value.

So when management decides to buy their own shares (when the stock price plummets unreasonably), it indicates that they believe the company is undervalued.

It’s like participating in insider trading…!

When are share buybacks detrimental?

Not all share buybacks are beneficial to the company. It depends on the motive and the effects of the buybacks.

If the share buybacks were done at overvalued prices, the effects are detrimental as the same amount of cash could be employed elsewhere for better returns. A company could trigger buybacks solely to support the stock price or push its stock price up.

Some companies conduct buybacks to issue stock options to their employees. While it could motivate employees to work harder, if done wrongly, it could be at the expense of existing shareholders. A double whammy as shares could have been bought back at overvalued prices, and reissued as options at undervalued prices.

So do you want to know what company that was?

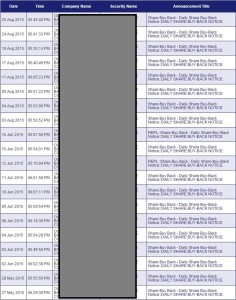

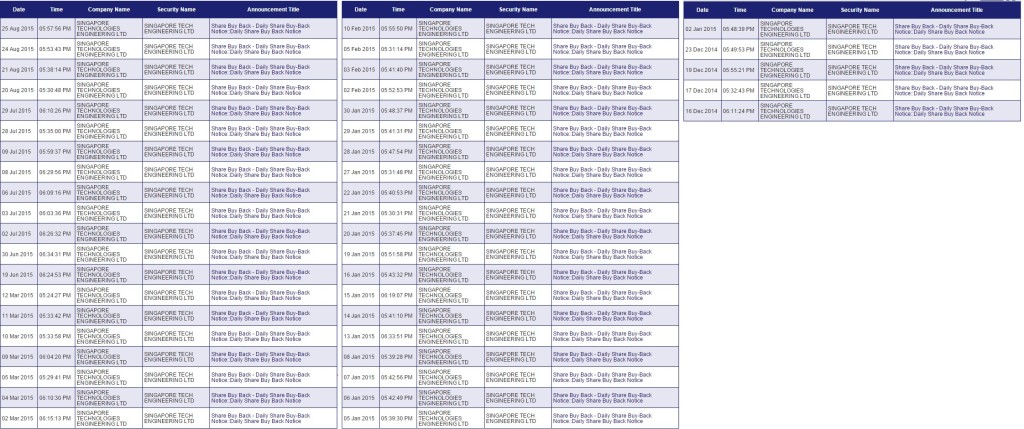

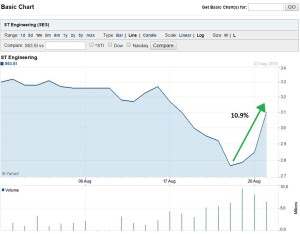

Some of you would have guessed it already. It is Singapore Technologies Engineering Limited (ST Eng), one of Asia’s largest defense and engineering groups. It is also a component stock of the FTSE Straits Times Index and MSCI Singapore. According to SGX, it has undertaken share buybacks ever since Dec 14. So far, it’s highest price for repurchase was $3.53 (5 Mar 15) and lowest at $2.75 (24 Aug 15).

So if you had bought at around $2.75, current stock price as of 28 Aug is $3.05, you could be sitting on a paper gain of 10.9%.

Feel good right? However, a word of caution, one must note that as investors, we usually do not realized our profits on such short term fluctuations. Such actions are those of a traders (there’s nothing wrong with trading. Trading can also be VERY profitable. It is however not a style that we at BSI are suited). Who knows, in a couple more days, the price could plunge again. We are for the long haul, investing in the future earnings of the company.

People invariably feel better after the market gains 600 points and stocks are overvalued, and worse after it drops 600 points and the bargains abound. – Peter Lynch, One up on Wall Street.

As you can see, when a solid company with good earnings deploys its own cash to fund share repurchases at stock prices below your valuation, you will be shopping with faith during the crisis when everyone else is panicking!

So, can you list some of the companies that are currently doing it? 🙂