Why you should start investing, even as an employee

In the previous articles on “Why you should invest”, we explained in detail why investing is the best hedge against inflation, increases your earnings without incurring tax, and continues to earn well after you stopped working. In this mini-series, let me share with you why you should start investing early,

One POWERFUL indicator to help you make sound investment decisions

Previously, we talked about share buybacks. This occurs when management uses its own company’s cash to repurchase its shares from the open market. If the CEO/directors used their OWN money to repurchase stocks of their own company from the open market, what would you think of the stock? Below is

How you could have made 10% in 3 days!

Some days back, I wrote an article on using share buybacks as references to capitalize on stock market crashes. So what is share buybacks? Also known as “share repurchases”, share buybacks occurs when a listed company buys its own shares from the stock market. You can see it as the company re-investing into itself. When

What do you do when the Great Global Sale Happens?

We believe by now, you are aware that the Great Global Sale is going on. Billions have been wiped out within seconds globally. As Warren Buffett always says, be greedy when others are fearful. Here is one example of a company being greedy when others are fearful. I even did

![Why should you invest [Part 2] everything else but 360x232 - Why should you invest [Part 2]](https://www.bytesizedinvestments.com/wp-content/uploads/2015/06/everything-else-but-360x232.png)

Why should you invest [Part 2]

We spoke about how inflation erodes one’s savings in one of our previous articles. Today, we would like to share how increasing active income is eroded by tax, and how you can increase your income in Singapore without incurring additional tax. Lastly, how to continue earning well after you have

Are Blue Chips Always Safe Investments?

As the saying goes, “Buy into a Blue Chip company because it will never go bankrupt”. We can’t deny that if a company has grown to a substantial size, with all the right systems in place, it runs at a lower business risk than that of a smaller counterpart. The

Why You Should Invest

When people are asked why should or shouldn’t you invest? Responses range from “it’s too risky”, “I do not know how to invest”, “I have no time to monitor”, etc One of the most common response will be “Investing is too risky”. Is it really risky? Perhaps an alternate viewpoint

Are You Investing, Trading Or Gambling?

Recently, I have been receiving a lot of questions from friends about how to start investing. In my opinion, the most important thing that one should know before he or she places a dollar in the stock market, is to understand the differences between Technical Trading, Fundamental Investing, and gambling.

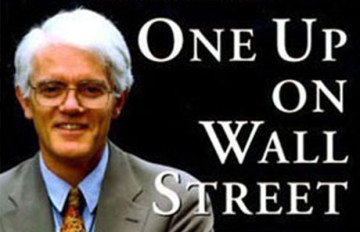

Book To Read: One Up On Wall Street

Available at: Amazon.com | iBooksOne Up On Wall Street is a book written by a professional Fund Manager, whose “invest in what you know” strategy has made him a household name with investors both big and small. His credentials? A legend at Fidelity Investments, famous for managing the Magellan Fund

7 Ways to Reduce Your Expenses Without Sacrificing Your Great Lifestyle

There are many articles online that teaches you how to save money, but most of them requires a certain level of sacrifice. In this article, we will find out that with a little effort, it is indeed possible to reduce your expenses, without having to sell your car or cut